- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING

For Artists who want to understand

(1) the true costs of an artwork

and

(2) how much profit they made from a sale

(1) the true costs of an artwork

and

(2) how much profit they made from a sale

|

Who is this Guide For?

Artists wanting to understand the true costs of an artwork and how much profit they made from a sale |

What does it cover?

Identifies a full cost approach to

|

DOWNLOAD MY GUIDE 'NUMBERS FOR ARTISTS - HOW TO WORK OUT PROFIT' FOR FREE

|

Copyright Katherine Tyrrell – all rights reserved for commercial purposes. You may use this guide for educational purposes only. You may NOT copy it or use it commercially in a workshop or other fee-paying context without the written prior agreement of and a license being granted by Katherine Tyrrell

| ||||||

NOTE: This guide was first published via

- Numbers for Artists: How to work out profit from an art sale | Making A Mark (23 January 2013)

- Making A Mark Guide: How to work out Profit from an Art Sale | Making A Mark website

OVERVIEW

how to work out how much profit you made from an art sale

This approach goes beyond the direct costs related to making the art.

It makes you think about all those other costs that a professional artist aiming to make a living from their art will need to recover and/or pay somehow – or go out of business.

It makes you think about all those other costs that a professional artist aiming to make a living from their art will need to recover and/or pay somehow – or go out of business.

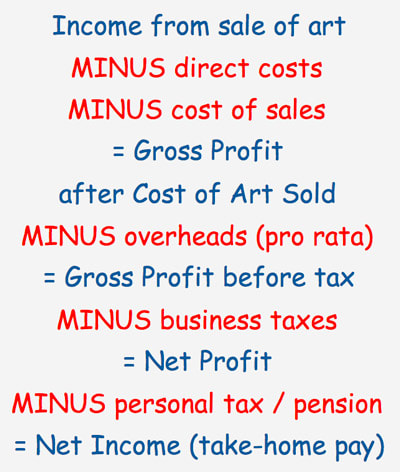

A BASIC APPROACH TO WORKING OUT PROFIT

|

The basic approach to calculating profit takes the money you get for a sale and then

= YOUR TAKE HOME PAY generated by the sale of art! The latter is the equivalent to a pay packet in a conventional job where the employer deducts tax at source. It’s the sum earned from the sale that you can actually spend on stuff that isn't connected with making art e.g. such as buying food and paying rent for your home. |

It's a proxy - but it's also an eye-opener!

To arrive at a realistic notion of your hourly wage, you can your divide your profit by the number of hours you took to create the work.. So – that’s the overview. Now we do it slowly and unpick pit by bit. I've split out all expenses incurred from all expenses allowed for tax purposes. This enables a review of what is/is not allowed as an allowable expense (or a tax allowance) in the current tax year. |

ADVERT

How to work out the "Cost Plus" approach backwards

NOTE:

- This isn't strictly accurate for proper accounts or doing accounts for the tax man (i.e. I'm ignoring all the little technical and allowable tweaks which are available) -

- BUT it gets you to a realistic figure re. profit from the perspective of managing your art business.

STEP 1: FIRST IDENTIFY THE INCOME FROM THE ART SALE

Identify the SALE PRICE the artwork was sold for – gross of any discount (i.e. discount is a cost of sale just like commission)

STEP 2: NEXT IDENTIFY AND DEDUCT "DIRECT COSTS" to work out NET INCOME

DIRECT COSTS are the costs specifically associated with the artwork you produced.

= Income net of direct variable costs

This is the figure many artists may think of as profit

- and yet it's a very long way short of real profit! If you find yourself going out of business, then this is probably why.

- Start with your SET PRICE (or price per square inch multiplied by your most frequent size of image sold)

- Deduct the MATERIAL COSTS of making the artwork. Another way of looking at this is you are about to find out how much money should be deducted from the sale to replace the materials you've just used up. So deduct the notional cost of raw materials. This isn't an exact science - you are allowed to use approximations! ;) (You could try working out a notional sum per square inch)

- Deduct the WAGES cost of anybody who helped you make the art (this might be in the form of a supplier's invoice that specifically relates to a piece of art)

- Direct costs are variable in the sense you don’t incur them unless you actually use art media and supports. For the purposes of this calculation we’ll assume you buy in just enough for the artwork produced – and ignore the stock of at materials that are sitting on the shelves.

= Income net of direct variable costs

This is the figure many artists may think of as profit

- and yet it's a very long way short of real profit! If you find yourself going out of business, then this is probably why.

STEP 3: NEXT WORK OUT YOUR "COST OF SALES"

- Deduct commission or sales fee at whatever percentage or sum is applied by the exhibition, gallery or vendor

- Deduct any discount offered by you or your art gallery/store e.g. for multiple sales, a "sales" period in your art store

- Deduct any specific "cost of sales" items that are unrelated to price or size (eg advertising; entry fees; cost of printing catalogues; transport/courier etc). You might want to share these across however many other artworks they cover - but be realistic about how many you actually expect to sell.

- Deduct the cost of matting/framing. You might reuse frames and mats - in which case determine the replacement cost in the case of a sale as the deduction.

= GROSS PROFIT after Cost of Production

This is the sum available for you to pay:

- your fixed costs of making art (eg studio, insurance)

- business taxes and financing costs

- some wages to yourself

ADVERT

STEP 4: IDENTIFY YOUR TOTAL FIXED COSTS RELATED TO ART

FIXED COSTS are the costs which keep on accumulating even when you're not making art. They don't stop when you take time off or go into hospital or on holiday.

For example:

Next step - divide your fixed costs by an estimate of the NUMBER OF ARTWORKS (or units) you sell each year and deduct the proportionate share.

This is much easier to work out if you typically produce work that is all the same size.

If you produce work in different sizes and price bands then work out a way of equating them all to a unit of fixed costs (e.g. small work = 1 unit; medium sized work = 3 units and large work = 5 units)

= GROSS PROFIT before tax and deductions and tax allowances

Remember that in cash terms that

For example:

- rent of studio space;

- depreciation of capital cost of equipment;

- professional annual insurance premium

- professional fees;

- broadband charges

- leasing charges

Next step - divide your fixed costs by an estimate of the NUMBER OF ARTWORKS (or units) you sell each year and deduct the proportionate share.

This is much easier to work out if you typically produce work that is all the same size.

If you produce work in different sizes and price bands then work out a way of equating them all to a unit of fixed costs (e.g. small work = 1 unit; medium sized work = 3 units and large work = 5 units)

= GROSS PROFIT before tax and deductions and tax allowances

Remember that in cash terms that

- this is what drives the cashflow until such time as you get the benefit of the expenses you can set off against tax.

- this is a useful place to start when you need to think about how much working capital/cash buffer you need to have to be a full-time artist. (i.e. the money you need to be able to incur expenditure so you can buy what you need to generate income - and wait for it to arrive)

- your working capital requirement may well grow as you grow your business - so don't forget to keep a close eye on this number.

STEP 5: NOW ADD BACK ALL EXPENSES ALLOWED TO OFFSET TAX

This is where you have identified an EXPENSE - and kept the receipt - which you are allowed

Advice from experienced artists who understand their tax accounts and what you can get deductions for can be helpful – but always double check advice from artists as they can sometimes have very curious ideas as to what’s allowed.

(e.g. can they state where it says in tax guidance this is allowed; do they have this in writing from their accountant?)

= GROSS PROFIT before tax and deductions

- EITHER claim as a tax allowance

- OR allowed as an LEGITIMATE business expense to reduce your tax bill. (This is NOT the same as all the expenses you incur. Don't ever claim an expense unless very sure it's recognised as a business expense)

Advice from experienced artists who understand their tax accounts and what you can get deductions for can be helpful – but always double check advice from artists as they can sometimes have very curious ideas as to what’s allowed.

(e.g. can they state where it says in tax guidance this is allowed; do they have this in writing from their accountant?)

= GROSS PROFIT before tax and deductions

STEP 6: DEDUCT ALL RELEVANT BUSINESS TAXES AND ANY INTEREST PAYMENTS DUE

The last deduction of all are the relevant financial outgoings due from the business e.g.

ALWAYS Remember that every country's tax system is unique and what applies in one country might not count in another.

= NET PROFIT after Business Tax and all allowed deductions / allowances

- payments of a business LOAN INTEREST and

- payment of all relevant BUSINESS TAXES (i.e. NOT personal tax - you are not your business).

ALWAYS Remember that every country's tax system is unique and what applies in one country might not count in another.

= NET PROFIT after Business Tax and all allowed deductions / allowances

STEP 7: CALCULATE TAKE HOME PAY

Now we need to work out much net income you actually will 'take home'

- Calculate how much you can contribute from each sale to your PENSION FUND - because you are planning on having an old age when you just paint for pleasure! (Depending on your country's tax regime you may be limited as to what percentage of earnings you can use as a pension contribution)

- Deduct TAX at the variable percentage rate relative to your assumed total income for the year. (e.g. For 2018/19 in the UK basic rate tax is 20% for all income between £11,851 to £46,350)

= NET INCOME which you get to spend on you - and your rent and food etc!

This is how much money you really made from the sale of that artwork!

|

ADVERT

|

ABOUT ART BUSINESS INFO. FOR ARTISTS

This website aims to provide a compendium of resources about the art business for artists. Please read "PLEASE NOTE"

It helps artists learn how to do better at being business-like, marketing and selling their art and looking after their financial security.

This website aims to provide a compendium of resources about the art business for artists. Please read "PLEASE NOTE"

It helps artists learn how to do better at being business-like, marketing and selling their art and looking after their financial security.

|

Copyright: 2015-2021 Katherine Tyrrell | Making A Mark Publications

- all rights reserved If you've got any suggestions for what you'd like to see on this website please send me your suggestion

|

PLEASE NOTE:

1) Content and the law change all the time. It's impossible to keep up with it if you're not working on the topic full time. 2) I research topics carefully. However, I am totally unable to warrant that ANY and/or ALL information is

|

3) Hence all information I provide comes without any LIABILITY whatsoever to you for any choices you make.

4) This website is FREE FOR YOU but not for me. Links to books are Amazon Affiliate links. Buying a book via this website means I get a very small payment which helps to fund and maintain this website. .I much appreciate any support your provide. Adverts are provided by Google AdSense - but the adverts do not mean I endorse the advertiser. |

- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING