- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING

This page is dedicated to information about UK tax for artists

|

Is your art in the UK a Hobby or a Business?

|

MORE INFORMATION is available on the following pages:

|

NOT on this site

|

This site does NOT provide:

|

You should engage/pay a professional for tax advice IF:

|

Banner Image: crop of HM Treasury and Foreign Office (on right) by Robert Scarf

HM Revenue and Customs, 100 Parliament Street, London SW1A 2BQ UK

HM Revenue and Customs, 100 Parliament Street, London SW1A 2BQ UK

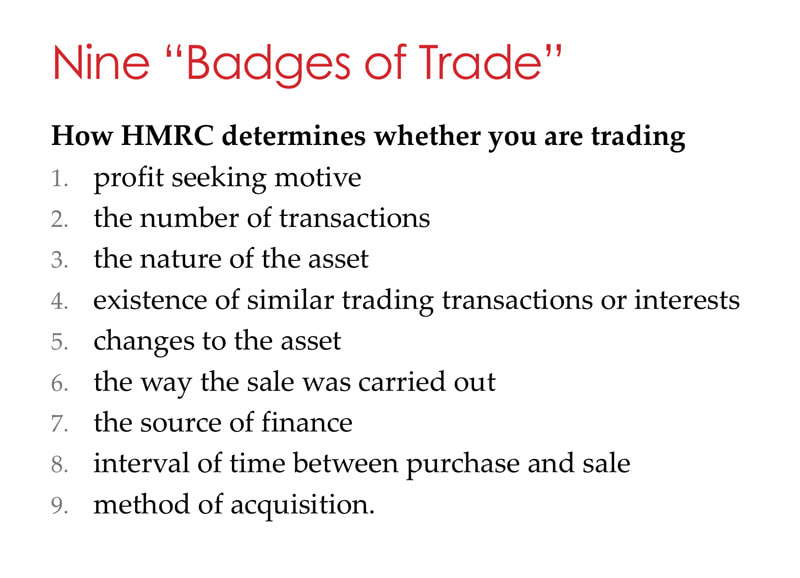

BADGES OF TRADE:

Is your art a hobby or a business in the UK?

What are the nine badges of trade?

Can you claim expenses against tax?

- The category “trading income” encompasses both

- income from a trade, for example plumbing or building and

- income from a profession or vocation. A profession would include accountancy or law. A vocation includes acting, ballet dancing, theatrical performing, sport etc.

Tolley's Tax Training

|

In the UK, there is a concept called the "Badges of Trade". This section is about:

As a rule of thumb if a hobby is profitable then it will be treated as being run on a commercial basis. |

|

A distinction is made between

These legal tests are known as the “badges of trade” (see the image and the box below) Importantly hobby income is unlikely to be defined as either if it has a history of losses (i.e. it is not operating in a commercial way). This means that any losses incurred may not be treated as business expenses and may not be used to offset tax liability. |

REFERENCE:

|

The Nine Badges of Trade - applied to art and artists

Profit seeking motive

Does HMRC think your motive is to make profit? If your behaviour indicates it is (e.g. Do you actively market it in exhibitions or online? Do you take commissions?), then your income from art sales will be considered to be business turnover and eligible for taxation.

HMRC introduced a £1,000 allowance for “hobby” activities in 2017 which make money. You no longer have to declare the income for taxation - and neither can you claim any expenses against tax. You might use this now as a benchmark as to whether or not HMRC might consider you to be trading.

2. Number of transactions

The number of transactions matter.

3. Nature of the asset

The issue is whether you would hold an asset as an ordinary individual.

4. Existence of similar trading transactions or interests

The issue here is whether the transactions you engage in are related to your normal work.

5. Changes to the asset

Do you repair, alter or improve items to make them more marketable at a higher price with a view to generating a profit? If you change an asset you have bought to make it more marketable (e.g oil paint and canvas become an oil painting) and you then sell it for significantly more than the cost of the art materials then you are indicating that this was the purpose of the painting and you are engaging in trade

6. The way the sale was carried out

If it looks like trading then it probably is trading.

7. The source of finance

If you needed a loan to buy your asset (eg a printing press)

8. Interval of time between purchase and sale

How long you hold an asset for is an important indicator of trade. Typically, people who trade successfully tend not to have a long period between the acquisition of the asset used (eg art materials) to create the asset that they then sell (eg artwork).

9. Method of acquisition.

This one works to indicate those who are NOT in trade. If the assets used for your art business are inherited or gifted to you, then your use of them is NOT an indication of trade. If you are a hobby printmaker, I guess I can’t think of a better reason for your significant other to give you a gift of a printing press!

Does HMRC think your motive is to make profit? If your behaviour indicates it is (e.g. Do you actively market it in exhibitions or online? Do you take commissions?), then your income from art sales will be considered to be business turnover and eligible for taxation.

- Even if you have a full time job doing something else

- Even if you don't actually make a profit.

HMRC introduced a £1,000 allowance for “hobby” activities in 2017 which make money. You no longer have to declare the income for taxation - and neither can you claim any expenses against tax. You might use this now as a benchmark as to whether or not HMRC might consider you to be trading.

2. Number of transactions

The number of transactions matter.

- Buying one item and reselling it or something you make from it after some input from you for may not indicate trade - IF it is not repeated.

- Repeating the same transaction over and over again matters. If you sell a lot of paintings (or other artwork) this can be considered to be a business.

3. Nature of the asset

The issue is whether you would hold an asset as an ordinary individual.

- If the asset you own and use to make income/profit is not personal, then this is a badge of trade.

- To demonstrate that your selling activity is a hobby, you may need to prove the goods gave you “pride of possession”, for example, you create pictures for personal enjoyment and hang them on your wall at home for a while before selling them.

4. Existence of similar trading transactions or interests

The issue here is whether the transactions you engage in are related to your normal work.

- Selling your car is not trade if you are an art teacher but may well be if you are a car mechanic.

- Selling artwork online if you work full-time as an art teacher, in a gallery or art shop or something else related to art might be taken to indicate you are engaging in trade i.e. they are related activities.

5. Changes to the asset

Do you repair, alter or improve items to make them more marketable at a higher price with a view to generating a profit? If you change an asset you have bought to make it more marketable (e.g oil paint and canvas become an oil painting) and you then sell it for significantly more than the cost of the art materials then you are indicating that this was the purpose of the painting and you are engaging in trade

6. The way the sale was carried out

If it looks like trading then it probably is trading.

- People who work professionally as artists take stands at art markets and art fairs

- If you do the same you stop being a hobby artist and start engaging in trade.

7. The source of finance

If you needed a loan to buy your asset (eg a printing press)

- AND you wouldn’t have bought it as an ordinary individual

- AND cannot afford to repay the loan without generating income from it e.g. the sale of fine art prints, then this indicates an intention to engage in trade.

8. Interval of time between purchase and sale

How long you hold an asset for is an important indicator of trade. Typically, people who trade successfully tend not to have a long period between the acquisition of the asset used (eg art materials) to create the asset that they then sell (eg artwork).

9. Method of acquisition.

This one works to indicate those who are NOT in trade. If the assets used for your art business are inherited or gifted to you, then your use of them is NOT an indication of trade. If you are a hobby printmaker, I guess I can’t think of a better reason for your significant other to give you a gift of a printing press!

ADVERT

Are you or your art generating "OTHER TAXABLE INCOME"

also know as "Additional Income" or a "Second Income"?

|

HMRC wants ALL income to be identified on your tax return including "additional income" which has been previously referred to as a "second income"

CHECK whether you need to report and pay any tax on income you make apart from your main job or earnings. |

As well as knowing what you can claim against tax, it's important to know what you need to declare. |

|

Examples of additional (second) income for somebody who is employed could be:

A casual receipt is taxable under the miscellaneous income sweep-up provisions where it is received for a service performed as agreed/arranged for reward. This contrasts with a simple gift as a ‘thank you’, for example, after performing a casual service where there was no agreement/arrangement/common expectation that such was for reward. |

Checks on Additional Income

Questions HMRC want answers to include:

REFERENCE

|

Can you claim expenses?

Whether or not you can claim expenses as business expenses and hence as tax deductions depends on whether or not you are conducting your activities as a hobby or a business

In short - an activity qualifies as a business if it is carried on with the reasonable expectation of earning a profit.

SEE BELOW

In short - an activity qualifies as a business if it is carried on with the reasonable expectation of earning a profit.

SEE BELOW

- Hobby Income Tax Allowance (UK) for artists without a business

- Allowable Business Expenses

HM REVENUE & CUSTOMS - TAX FOR ARTISTS IN THE UK

This section is relevant to all UK Residents

Her Majesty's Revenue & Customs - Self-Assessment

Separate personal and business taxes

|

Check if you need to tell HMRC about income that’s not from your employer, or not already included in your Self Assessment if you work for yourself REASONS WHY HMRC MAY CHECK UP ON YOU

The following may prompt a compliance check into your tax affairs.

HMRC actively search for non-registered businesses and undeclared business income. If caught you will have to pay interest and penalties in addition to any outstanding tax. |

Register your business

|

This page tells you how to register as a sole trader with HMRC and pay tax and national insurance contributions on your profits after allowable expenses.

You'll get a reference number, an online account and it becomes much easier to register for other taxes such as VAT You will then get a business tax account in addition to any personal tax account. |

If you start working for yourself, you’re classed as a sole trader - even if you haven’t yet told HM Revenue and Customs (HMRC). REFERENCE:

|

You need to set up as a sole trader if any of the following apply:

- - you earned more than £1,000 from self-employment between 6 April 2021 and 5 April 2022

- - you need to prove you’re self-employed, for example to claim Tax-Free Childcare

- - you want to make voluntary Class 2 National Insurance payments to help you qualify for benefits

- Set Up as a Sole Trader | HMRC

How to become self-employed and pay tax properly!

STEP 1 Check if being self-employed is right for you

There are other ways to work for yourself. Check if you should set up as one of the following instead:

STEP 2 Choose the name you want to trade under

You can register a trade mark if you want to stop people from trading under your business name.

STEP 3: Check what records you'll need to keep

STEP 4: Register for tax (see videos below)

To pay tax, you'll need to register for Self Assessment. You may also need to register for VAT.

REFERENCE: See Set up as self-employed (a 'sole trader'): step by step on the HMRC website

There are other ways to work for yourself. Check if you should set up as one of the following instead:

- Get help deciding how to set up your business

- Get help starting your own business if you're on benefits

- Check what being self-employed means

- a limited company

- a partner in a business partnership

STEP 2 Choose the name you want to trade under

You can register a trade mark if you want to stop people from trading under your business name.

STEP 3: Check what records you'll need to keep

STEP 4: Register for tax (see videos below)

To pay tax, you'll need to register for Self Assessment. You may also need to register for VAT.

REFERENCE: See Set up as self-employed (a 'sole trader'): step by step on the HMRC website

By law you are required to tell HMRC Revenue and Customs about any income that is not fully taxed, even if you are not sent a tax return.

HM Revenue and Customs

|

Video: Registering for Self Assessment

This video explains how to register your new business online with HM Revenue & Customs so that you can complete a Self-Assessment tax return. |

|

|

Video: Your first Self Assessment tax return

This video gives you guidance on

|

|

You can also view lots more helpful HMRC Videos on

- Self Assessment Help and Deadlines to see the entire list of helpful HMRC Videos that are available

- the UK: Self-Assessment Video Tips page on this website

Keep an eye out for the regular HMRC webinars and videos which help you to understand more about how tax works and what you need to do and what records you need to keep.

REFERENCE:

It takes a while to find all the pages which are relevant to artists - so here's a shortcut!

It takes a while to find all the pages which are relevant to artists - so here's a shortcut!

- HMRC: Login

Welcome to HMRC Online services

- HM Revenue & Customs: Introduction to tax allowances and reliefs

Overview of allowances and reliefs that can reduce your tax, with links to further guidance - HM Revenue & Customs: Tax allowances and reliefs if you're self-employed

Overview of allowances, reliefs and deductions available if you’re self-employed – links to detailed guidance and how to claim - HM Revenue & Customs: Tax returns if you're self-employed or in a partnership

Completing the Self Assessment tax return and record keeping if you're self-employed or in a partnership - HM Revenue & Customs: Completing your tax return (self-employed)

How to complete the return, forms you’ll need, what to do if you have incomplete figures, what to do if you have a problem - HMRC: HS234 - Averaging for creators of literary or artistic works

Guidance to help authors and artists who have fluctuating profits fill in the Self-employment or Partnership pages of their Tax Return. Who can claim, conditions, how the claim works. - National Insurance and tax after State Pension age - You don't have to pay national insurance after you reach the age when you begin to receive a state pension. When you estimate your taxable income you must include the pension(s) you receive as well.

ADVERT

Hobby Income Tax Allowance (UK) for artists without a business

HMRC is very keen on making sure all those with UNTAXED INCOME PAY TAX

This section relates to all individuals who are generating trading income - but treating it as a HOBBY - and not declaring it for tax.

This section relates to all individuals who are generating trading income - but treating it as a HOBBY - and not declaring it for tax.

|

The Hobby Income Allowance

From 6th April 2017 a new allowance was introduced for those people generating hobby income. The aim was to remove c.700k people from the need to complete a self-assessment return because they are making money from their hobby. It also provides a benchmark for when income effectively stops being a hobby. So long as your annual hobby income in a tax year does NOT exceed £1,000 you will no longer need to

|

In the UK, a hobby artist can find out if they have to complete a tax return by completing a very simple questionnaire called Check if you need to fill in a Self Assessment tax return which is available on the main government website.

HOWEVER DON'T FORGET!

As soon as you exceed £1,000 income per tax year you need to:

|

You must tell HMRC if you have: |

UK Non- Official REFERENCE ARTICLES about Hobby Income:

|

Tax-free allowances on property and trading income | GOV.UK -

- This measure introduces 2 new annual tax allowances for individuals of £1,000 each, one for trading and one for property income

- These new allowances will take effect from the tax year 2017 to 2018.

- If your annual gross trading OR property income is £1,000 or less and you’re not registered for Self Assessment, you won’t have to declare this income on a tax return.

- However you must keep a proper record of this income.

- (Helpsheet 325 has more information about other taxable income)

|

NOTE FOR INFORMATION:

The Second Income Campaign / Crackdown A few years ago HMRC declared a campaign to crack down on all those in the UK with an untaxed Second Income and who had failed to declare it for taxation purposes. THIS DISCLOSURE OPPORTUNITY CLOSED ON 7 AUGUST 2017 The criteria for an individual to take part in this disclosure facility was as follows:

|

There was an the opportunity to make a clean breast of it and get your tax affairs up to date in return for a reduced level of penalties for not coming clean earlier.

Terms of the Second Incomes Campaign were that once notification of an intention to make a voluntary disclosure is made, the taxpayer has 4 months to calculate and repay what is owed in unpaid tax. REFERENCE: |

The Second Incomes Campaign is an opportunity for individuals to bring their tax affairs up to date if they have additional income that is not taxed through their main job or another Pay As You Earn (PAYE) scheme.

Allowable Business Expenses

These (generic) HMRC videos provide an accessible introduction to how expenses work if you are self-employed

|

Expenses if you're self-employed

|

Simplified (flat-rate) expenses

For sole traders and partnerships which don't have limited companies as partners. Small self-employed businesses have the option to use cash basis accounting and simplified expenses. HMRC Help pages: |

|

|

|

|

Guidance on Business Use of your Home: I recommend you check the date of the Information and whether or not it has been updated. Note the Capital Gains Tax consequences.

|

Motoring expenses if you are self-employed

|

Part 4: Taxable profits

Tells you where and how to include your expenses

HMRC Help Pages:

Tells you where and how to include your expenses

HMRC Help Pages:

- How to calculate your taxable profits: HS222 Self Assessment helpsheet

- HS222 How to calculate your taxable profits (2018)

Budgeting for and Paying your self-assessment tax bill

|

Completing the self-assessment return is not the end.

Now you have to pay your tax bill! The two videos below provide help about:

|

These HMRC advice notes provide additional guidance about budgeting and paying self-assessment tax bills. (see below)

REFERENCE: Art Business Info Tax Tips for UK Artists

|

VIDEO: Budgeting for your Self Assessment Tax Bill

HMRC help pages

HMRC help pages

- Budget for your Self Assessment tax bill if you're self-employed - this gives to access to an online ready-reckoner tool

- Pay your Self Assessment tax bill - budget payment plan - this details the budget payment plan available - of you plan ahead

|

|

|

|

HMRC Paying your Self Assessment tax bill

Visit GOV.UK to find out more about The HMRC app |

|

HMRC - Making Tax Digital for Income Tax Self Assessment (MTD for ITSA)

|

In December 2015 the Government announced its intention to change the way the tax system operates to make it more efficient and effective for both the taxpayer and the government machine.

The roll-out of Making Tax Digital for Income Tax Self Assessment (MTD for ITSA) has been much delayed - in part due to the pandemic. The introduction of Digital Tax will

NOTE: As of April 2019, the vast majority of businesses registered for VAT, that have a taxable turnover above the threshold level of £85,000, have been required to keep digital VAT business records and send returns using Making Tax Digital (MTD) compatible software. |

IN FUTURE - in the tax year beginning April 2024. - MTD for ITSA will be introduced for individual businesses and property landlords

The information to be submitted quarterly will use exactly the same income and expense categories as those included in the current supplementary tax return pages for self-employment and property income. Some businesses and agents are already keeping digital records and providing updates to HMRC as part of a live pilot to test and develop the Making Tax Digital service for Income Tax. If you are a self-employed business or landlord you can voluntarily use software to keep business records digitally and send Income Tax updates to HMRC instead of filing a Self Assessment tax return. |

|

: REFERENCE - HMRC

|

REFERENCE: Independent Articles

|

In 2015, then Chancellor of the Exchequer, George Osborne, announced the biggest change to the UK tax system since the introduction of Self Assessment, as he declared “the death of the annual tax return” accompanied by “a revolutionary simplification of tax”. Neither has yet to be delivered but, if you look past the headlines and rhetoric, HMRC’s Making Tax Digital programme is less about making tax digital and more about making bookkeeping digital.

The spreadsheet is dead, long live the spreadsheet | Tax Calc Blog

I'll be researching and writing further on this matter. Subscribe to my News Blog if you want to keep in touch with what is happening - and get updates on other art business matters.

BELOW is an HMRC video about Making Tax Digital - for businesses

Inheritance Tax in the UK - Tax Incentives

|

There are three schemes geared towards offering tax incentives in connection with cultural property.

Details of these are provided on the Art Council website. |

|

|

ADVERT

|

ABOUT ART BUSINESS INFO. FOR ARTISTS

This website aims to provide a compendium of resources about the art business for artists. Please read "PLEASE NOTE"

It helps artists learn how to do better at being business-like, marketing and selling their art and looking after their financial security.

This website aims to provide a compendium of resources about the art business for artists. Please read "PLEASE NOTE"

It helps artists learn how to do better at being business-like, marketing and selling their art and looking after their financial security.

|

Copyright: 2015-2021 Katherine Tyrrell | Making A Mark Publications

- all rights reserved If you've got any suggestions for what you'd like to see on this website please send me your suggestion

|

PLEASE NOTE:

1) Content and the law change all the time. It's impossible to keep up with it if you're not working on the topic full time. 2) I research topics carefully. However, I am totally unable to warrant that ANY and/or ALL information is

|

3) Hence all information I provide comes without any LIABILITY whatsoever to you for any choices you make.

4) This website is FREE FOR YOU but not for me. Links to books are Amazon Affiliate links. Buying a book via this website means I get a very small payment which helps to fund and maintain this website. .I much appreciate any support your provide. Adverts are provided by Google AdSense - but the adverts do not mean I endorse the advertiser. |

- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING