- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING

A career as an artist does not come with a pension plan.

You need to think about how you will cope financially when you need to retire.

You need to think about how you will cope financially when you need to retire.

|

This page aims to:

It's very much orientated to the UK and Ireland as I know very little about pension arrangements in different countries |

Contents (below):

|

Disclaimer: I'm not a professionally qualified expert in this area. However everybody has to start somewhere and the aim of this website is to get you thinking about the right questions to think about and ask if and when you need to get professional advice. The links contained on this website are those which could be found by anybody doing extensive research on the Internet.

Artists and retirement - Do artists ever retire?

|

Being an artist means no official retirement age.

When you're self-employed you can carry on for as long as you are able. Some are tempted to think you'll be able to carry on working as an artist - and selling work - for a lot longer than may in fact be possible. Young people are not well acquainted with all the ways in which your body begins to fail as it gets older. So there is a need to consider how you can make provision for your retirement. |

Do artists retire?

A number of artists work well into old age - and do good work. Others have eyesight which fails, limbs which seize up and dexterity which eventually becomes poor.

|

A Wide Range of Perspectives on Retirement

The gallerist Edward Winkleman started an interesting open thread back in 2011 on the topic of Retiring as an Artist | Open Thread.

The comments posted suggest a very wide variety of perspectives - which certainly suggests that the traditional notion might be true for some but certainly not everybody:

The gallerist Edward Winkleman started an interesting open thread back in 2011 on the topic of Retiring as an Artist | Open Thread.

The comments posted suggest a very wide variety of perspectives - which certainly suggests that the traditional notion might be true for some but certainly not everybody:

- people suggested that artists' later works are often the best they ever produce

- notions that a creative activity will always continue when it is aligned with an internal impulse to create

- the traditional identity of "the real artist" can be enormously inhibiting to the notion of being able to give up or slow down

- a view that being an artist is very tiring. You're under horrendous pressure to produce and sell art

- some artists who have worked really hard for 50 years would like permission to slow down

- for some artists retirement means not having to produce art to sell and not having to provide art for exhibitions

- queries about whether artists can ever afford to retire

- a wish that some of the artists who have made it big would retire to give others a chance to sell their work!

Do artists ever make provision for a pension?

Most artists have no pension plan and are completely reliant on state support - or a spouse who has a pension plan.

|

Typical reasons why are as follows:

|

Artists who died in povertyThere's a VERY lengthy history of artists who were starving during their lifetime - and others who did well but were not great at planning for their old age and a time when they could no longer make art

Rembrandt (1606-1669) lived beyond his means during his lifetime, became a bankrupt and died in Amsterdam in 1669 as a poor man and was buried in an unmarked pauper's grave Vermeer (1632-1675) His wife attributed his early death at age 42 to financial stress. He lived on the edge of poverty for most of his life and in the final year became burdened by a large loan taken out after very poor economic conditions stopped his patrons paying for his work. Hokusai (1760 – 1849) lived to a great age and produced most of his artwork after the age of 60. However in 1839, as his career was beginning to fade a fire destroyed most of the artwork in his studio. Van Gogh (1853-1890) His paintings might be worth a lot now but he only sold one painting during his lifetime, depended on his brother for funds and died penniless age 37. |

Contemporary artists are no better at pension planning

Various surveys in the UK reveal that very few artists have made provision for their pension.

Key findings so far include:

- The Pensions for Artists research commissioned by Arts Council England in 2007 showed that 70% of artists (across all artforms) didn’t have a private pension. (In the UK working population as a whole, 44% don’t have a private pension.)

It also showed that affordability is the key factor in whether artists save for their pensions, and that artists are twice as likely as the working population as a whole to earn under £10,000 a year.

- However, given that 50% of artists nowadays are self-employed and hence are the sole contributor to their own savings. This presents a significant challenge in creating an affordable, well-adopted scheme for visual and applied artists.

A-N | Artists’ pensions research update (December 2012)

This is the Survey I started in 2015 - see my blog post Retirement and Pensions for Artists

Please vote first and then view the results by clicking the link near the bottom

|

|

Only 16% of artists surveyed paid in to private pensions. Given that 50% of artists are self- employed this presents a significant question as to how professional artists will support themselves once they reach retirement age. |

However the situation in some countries is rather better.

A number of countries provide social security measures for artists around pensions and retirement. For example, special pension schemes for artists are available in Germany (via the KSK), Italy (via ENPALS), France, Finland and Austria

The Living and Working Conditions of Artists in the Republic of Ireland and Northern Ireland (April 2010)

|

ADVERT

|

|

How to fund a pension if you are an artist

Self-employment versus Paid Employment

|

The chances are if you are self-employed you only started to think about pension planning very late in the day.

Unlike those in regular employment, there is no requirement to make sure self-employed people have an adequate pension provision. You also cannot access the tax relief available for pension provisions if you do not have a personal pension plan. The problem is that the later you leave it before you start to think about pensions and then commit to a pension plan, the bigger the contributions you will have to make to create any sort of pension at all. |

A number of artists think there's a lot to be said for having paid employment to support their art practice e.g. a regular job - such as being an art teacher.

This then allows you to build up a pension pot in terms of employment related pension planning. REFERENCE:

|

Using art as a pension pot

Many artists simply use the proceeds from the sales of saved works to support themselves once they slow down or stop making art altogether.

Alan Bamberger - in the USA advocates reserving artwork and spacing out sales over time. He explains how and why in The Benefits of Saving Art - Someday It'll be Your Retirement Fund...and Maybe More. This highlights how:

However those that have attempted to create a scheme where artists can do this together have run into problems - see the Case Study of the Artist Pension Trust below.

- artists should never get rid of their art

- art collectors value the work of successful artists - even the early stuff!

- not everybody wants your latest creations

- you can't do a retrospective without examples of your artwork from across the years

However those that have attempted to create a scheme where artists can do this together have run into problems - see the Case Study of the Artist Pension Trust below.

CASE STUDY: The Artists Pension Trust

|

The Artist Pension Trust (APT) is a mutual assurance scheme founded in 2004. APT's Chairman and co-founder is the high-tech entrepreneur and art collector Moti Shniberg, Chairman of MutualArt. It is an unorthodox investment vehicle to help artists plan for retirement. It is a global organisation, owned and managed by Mutual Art.

Artists were curated / invited to participate. It works(?)/worked on the basis of setting aside artworks in a Pension Trust so as to provide a stream of returns over the long term and to spread the benefits of a rising reputation. HOWEVER It has was MUCH CRITICISED (after trying to introduce a new storage fee and endeavouring to sell art art auction) and the website and all social media accounts are now all dead. The website stopped being indexed by the Wayback Machine on 4th April 2020. There is also no obvious reference to the Fund on the MutualArt website. It's VERY unclear what is the current status of the Trust and its assets. “the reluctance of artists to sell at auction highlights why financial models are difficult to apply to art.” Phillip Gleadell Among the artists seeking to withdraw from APT are Turner Prize–winners Jeremy Deller, Douglas Gordon, and Richard Wright, as well as British artists Bob and Roberta Smith and David Shrigley. |

REFERENCE:

These are articles about the Artist Pension Trust:

|

Changes to pension planning in the UK

|

There have been a lot of changes in the field of pensions in the last few years.

Even those in jobs which are relatively secure face the prospect of having to work until they are very old to earn a pension which will be worth a lot less than might have been possible in the past for the somebody doing the same sort of job. The problem is threefold.

And that's how it is for people with jobs! |

There is an even bigger problem for those who are self-employed and who don't have an employer.

All artists who are 100% self-employed do NOT get their pension pot topped up by employers' contributions, The reality is that they actually need to use MORE of their income to make provision for their pension - because of the lack of any contribution from an employer. That's all before you get to the horrendous language and technical concepts you have to get to grips with when trying to make a decision about the best way forward. |

|

ADVERT

|

|

How much state pension will you get in the UK?

This is a very simple explanation of how to make sure you get a state pension, what you have to pay and when you will be eligible.

I very much RECOMMEND you tackle this topic sooner rather than later if you want to maximise your State Pension.

I give no assurances that this information is completely up to date or wholly relevant to your circumstances. I RECOMMEND that you read all the pages on the GUV.UK website on this topic and/or consult with the Department of Work and Pensions.

I very much RECOMMEND you tackle this topic sooner rather than later if you want to maximise your State Pension.

I give no assurances that this information is completely up to date or wholly relevant to your circumstances. I RECOMMEND that you read all the pages on the GUV.UK website on this topic and/or consult with the Department of Work and Pensions.

The new State Pension is a regular payment from the government that you can claim if you reach State Pension age on or after 6 April 2016. |

are very imIf you have made no additional provision you will be entitled to a state pension - but ONLY if you have made NI contributions.

UK Government: This government website explains how your state pension is calculated in principle

An artist (in the UK) - being self-employed - usually pays two types of National Insurance contributions:

NI Contributions Class Rate for tax year 2020 to 2021 The current rates of contributions are as follows

Gaps in National Insurance:

REFERENCE: |

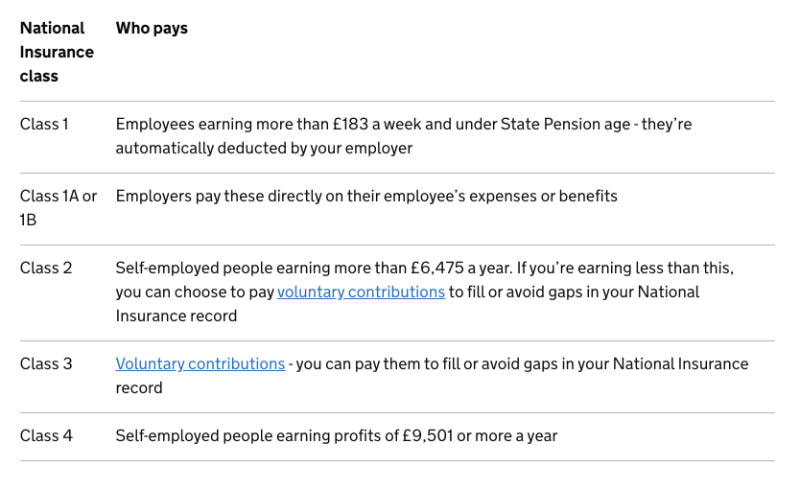

Who pays National Insurance?

Below is a table of who pays COMPULSORY National Insurance contributions in the UK and when they start paying.

Note that it says you can pay voluntary contributions if self-employed - to fill or avoid gaps in your NI record - and your profit from self-employment has not yet reached the threshold for mandatory payment of Class 2.

Source: National Insurance | Gov. UK

Note that it says you can pay voluntary contributions if self-employed - to fill or avoid gaps in your NI record - and your profit from self-employment has not yet reached the threshold for mandatory payment of Class 2.

Source: National Insurance | Gov. UK

Pensions for Artists in Ireland

Visual Arts Ireland have a very useful page on Pensions for Artists with recommendations for an option artists can consider.

|

ADVERT

|

ABOUT ART BUSINESS INFO. FOR ARTISTS

This website aims to provide a compendium of resources about the art business for artists. Please read "PLEASE NOTE"

It helps artists learn how to do better at being business-like, marketing and selling their art and looking after their financial security.

This website aims to provide a compendium of resources about the art business for artists. Please read "PLEASE NOTE"

It helps artists learn how to do better at being business-like, marketing and selling their art and looking after their financial security.

|

Copyright: 2015-2021 Katherine Tyrrell | Making A Mark Publications

- all rights reserved If you've got any suggestions for what you'd like to see on this website please send me your suggestion

|

PLEASE NOTE:

1) Content and the law change all the time. It's impossible to keep up with it if you're not working on the topic full time. 2) I research topics carefully. However, I am totally unable to warrant that ANY and/or ALL information is

|

3) Hence all information I provide comes without any LIABILITY whatsoever to you for any choices you make.

4) This website is FREE FOR YOU but not for me. Links to books are Amazon Affiliate links. Buying a book via this website means I get a very small payment which helps to fund and maintain this website. .I much appreciate any support your provide. Adverts are provided by Google AdSense - but the adverts do not mean I endorse the advertiser. |

- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING