- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING

|

There's only one way to get on top of your tax affairs and that's to identify and address your weaknesses

- or pay somebody to do it for you. |

This site is for those who think they can do better at tax - and aren't yet ready to pay somebody else to do their tax return.

|

Information and advice about tax for artists

|

Does tax frighten you?

Are 'creating art' and 'completing a tax return' two activities which you regard as totally incompatible? Take a look at this page if you're an artist who'd like to try do better in relation to:

|

|

OTHER DEDICATED COUNTRY PAGES now provide links to formal information and advice about:

|

These pages look at:

|

|

Plus Tax TIPS from:

|

Plus Videos by bona fide experts

This website is read by people all over the world so I'm sticking to the simpler principles which help artists to cope with their tax returns and maximising their allowable expenses |

NOT on this site

|

This site does NOT provide:

|

I RECOMMEND you pay a professional for tax advice IF:

|

Tax Tips - by artists - for artists

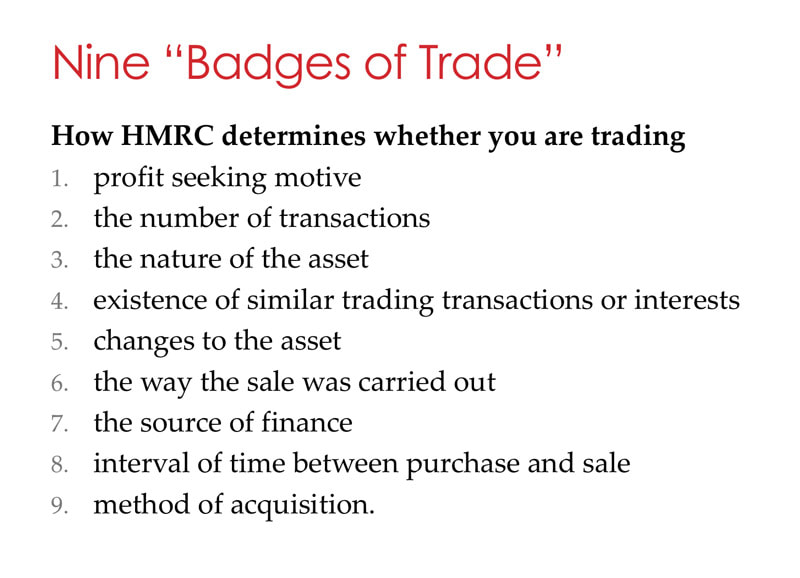

the taxman will class you as a business if it can prove you are doing “anything in the nature of trade”

The Telegraph - HMRC targets Etsy, eBay and Gumtree sellers – but when is your hobby taxable?

In summary, my top tax tips for artists are:

|

PRINCIPLES

SPREADSHEET SKILLS

ORGANISATION

EXPENSES

|

ACCOUNTS

BANKING

TAX RETURN

TRICKY ASPECTS

I've often come across artists who tell me they're not good at book-keeping or keeping track of their records of income and expenditure for tax purposes. |

|

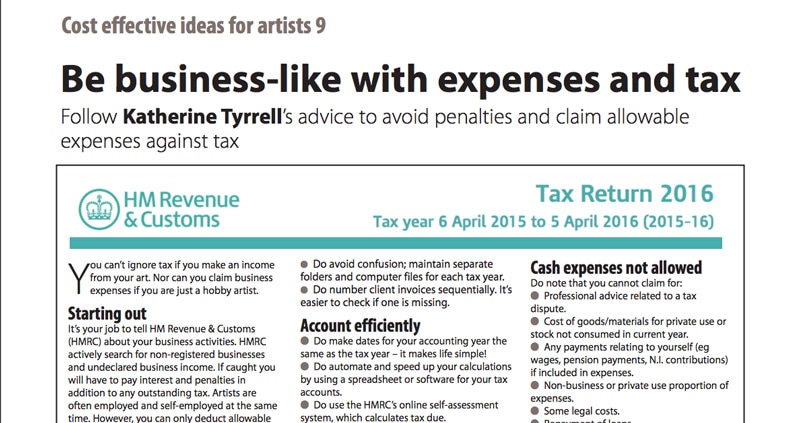

This is a round-up of the websites, blog posts and articles about tax which have been written with artists in mind.

I've written various blog posts covering:

|

REFERENCE: These are:

|

ADVERTISEMENT

Blogging about Tax

Art Business Info - News about art for Artists

Top Tax Blogs

|

These are tax blogs written by people professionally qualified to comment on tax - who provide accessible advice written for the small business person.

|

|

ADVERTISEMENT

More tips about tax

I've categorised the links by the type of person offering the advice

|

By art business bods

|

By Tax Advisers (UK)

|

Minding Your Business: A Guide to Money and Taxes for Creative Professionals

by Martin Kamenski

by Martin Kamenski

|

This book focuses on communicating in plain English rather than "accountant speak" despite the fact the author is a fully qualified and practising certified accountant.

This is his fine-tuned explanation of how to deal with what's needed for your tax affairs if you are a creative person |

Paperback: 128 pages

Publisher: Hal Leonard Books Publication Date: December 1, 2012 RECOMMENDED: Rated an average of 4.4 out of 5 stars on Amazon.com by 5 reviewers - there are some very complimentary reviews! BUY THIS BOOK |

What aspect of tax puzzles you?It's useful for me to know what questions you want answers to. Ask Away - using the contact form.

Issues raised will ONLY inform the future development of this section of the website and my blog posts. PLEASE NOTE:

|

|

|

DISCLAIMER

|

ADVERT

|

ABOUT ART BUSINESS INFO. FOR ARTISTS

This website aims to provide a compendium of resources about the art business for artists. Please read "PLEASE NOTE"

It helps artists learn how to do better at being business-like, marketing and selling their art and looking after their financial security.

This website aims to provide a compendium of resources about the art business for artists. Please read "PLEASE NOTE"

It helps artists learn how to do better at being business-like, marketing and selling their art and looking after their financial security.

|

Copyright: 2015-2021 Katherine Tyrrell | Making A Mark Publications

- all rights reserved If you've got any suggestions for what you'd like to see on this website please send me your suggestion

|

PLEASE NOTE:

1) Content and the law change all the time. It's impossible to keep up with it if you're not working on the topic full time. 2) I research topics carefully. However, I am totally unable to warrant that ANY and/or ALL information is

|

3) Hence all information I provide comes without any LIABILITY whatsoever to you for any choices you make.

4) This website is FREE FOR YOU but not for me. Links to books are Amazon Affiliate links. Buying a book via this website means I get a very small payment which helps to fund and maintain this website. .I much appreciate any support your provide. Adverts are provided by Google AdSense - but the adverts do not mean I endorse the advertiser. |

- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING