- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING

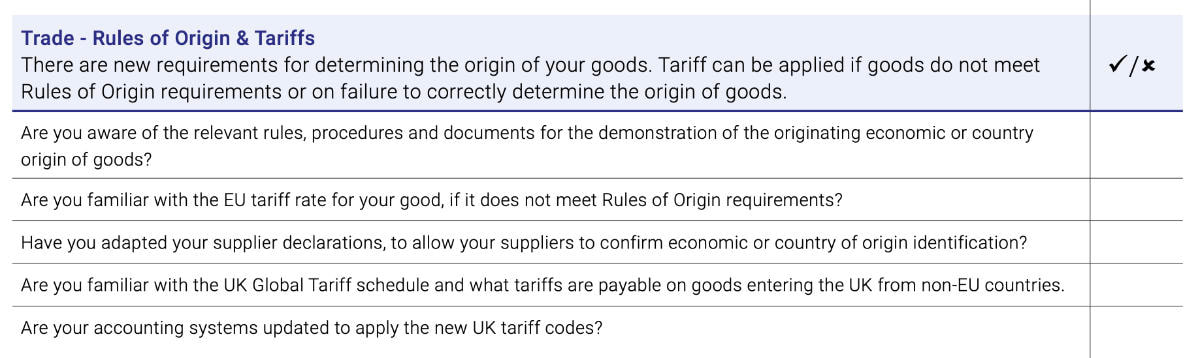

"Rules of Origin" are a HIGHLY TECHNICAL aspect of

international trade & shipping between different countries.

At the moment, this page mainly comprises links I've collected that are likely to be useful to

those engaged in international shipping of goods in or out of the UK / EU / Rest of the world

i.e. Import, export and customs for businesses.

It is a "work in progress" and will become increasingly relevant to the art business.

It will also be developed further with the aim of making the rules simpler to understand.

However it's guaranteed to make my head hurt so this may not happen quickly!

international trade & shipping between different countries.

At the moment, this page mainly comprises links I've collected that are likely to be useful to

those engaged in international shipping of goods in or out of the UK / EU / Rest of the world

i.e. Import, export and customs for businesses.

It is a "work in progress" and will become increasingly relevant to the art business.

It will also be developed further with the aim of making the rules simpler to understand.

However it's guaranteed to make my head hurt so this may not happen quickly!

Below you can find:

- statements about what are "rules of origin" - everybody says it slightly differently

- references to official documents produced by the UK government, EU Taxation and Customs Union and the World Trade Organisation.

- an attempt to relate all these to the art business - hopefully this will become better / clearer over time!

What are "Rules of Origin"?

Rules of origin are the rules to attribute a country of origin to a product in order to determine its "economic nationality". Rules of Origin | Wikipedia

|

Rules of origin are

|

Origin in "Rules of Origin" relates to

Origin determines

Various trade bodies determine the rules of trade and rules of origin for their area - and those they trade with. i.e. there is no one set of universal rules - AND they can change at any time! |

Rules of Origin and the Art Business

|

If an artwork created or the art goods or art products made are to be shipped across national borders to customers / distributors, it may well be ESSENTIAL (put VERY simply) to:

|

The main problem for artists and any art businesses is an almost complete LACK of:

Virtually all the documentation and training assume

HOWEVER one good thing coming out of recent events is that governments now recognise much more clearly how dependent they are on small/micro businesses for supply of goods - so this situation may change |

EXAMPLES: I'm trying to think of ways of explain the practical impact and have come up with these examples to date:

- If you frame your artwork prior to export, you may need to be able to certify where that wood comes from.

- If the paint brush you make includes animal hair you may well need a certificate of origin for that hair - because some countries you may export to will require one (see Kolinsky Sable Brush Availability | Artist Network - which explains how after CITES agreed to monitor Kolinsky Sables (because their ID was being misappropriated) this led to difficulty in obtaining sable brushes in all those countries (e.g. the USA) which required a certificate of origin/export)

- manufactured art goods (e.g. crafts) need to note that manufactured food goods ran into problems crossing between countries with a free trade agreement if one component came from outside the free trade area - as happened in relation to UK/EU trade post Brexit after 1 January 2021.

Preferential rules of origin

|

Preferential origin is used solely to provide duty benefits through a Free Trade Agreement and is optional.

This means:

|

Preferential rules of origin determine whether goods qualify as originating from certain countries, for which special arrangements and agreements apply. |

In late December 2021, the UK and the European Union (EU) signed a Trade & Cooperation Agreement which brought to an end the transition period - and now allows free trade of goods across borders - so long as those goods do not involve components from a third country.

Non-Preferential rules of origin

|

Non-preferential rules of origin apply when countries wish to

Non-preferential rules of origin are those

|

Outside a customs union, all UK exporters will still have to declare the origin of their goods when trading with the EU. This is used by importing countries to protect their producers and for other monitoring purposes. REFERENCE:

|

ADVERT

The use of bold in the quotations below is determined by me.

Rules of Origin according to World Trade Organisation

Determining where a product comes from is no longer easy when raw materials and parts criss-cross the globe to be used as inputs in scattered manufacturing plants. Rules of origin are therefore needed to attribute one country of origin to each product. They are the criteria used to define where a product was made and are important for implementing other trade policy measures, including trade preferences (preferential rules of origin), quotas, anti-dumping measures and countervailing duties (non-preferential rules of origin). |

REFERENCE

World Trade Organisation

|

Rules of Origin according to the European Taxation and Customs Union

Rules of origin determine where goods originate, i.e. not where they have been shipped from, but where they have been produced or manufactured. |

REFERENCE: European Union

|

|

I am an EU exporter, exporting to the UK 10 STEPS TO TAKE

|

I am an EU importer, importing from the UK 10 STEPS TO TAKE

|

The above is based on PART TWO: TRADE, TRANSPORT, FISHERIES AND OTHER ARRANGEMENTS , HEADING ONE: TRADE TITLE I: TRADE IN GOODS, Chapter 2: Rules of origin, Section 2: Origin procedures

ADVERT

Rules of Origin according to the UK Government - after 1st January 2021

The rules of origin requirements are some of the most important provisions that your business needs to understand and comply with, under the UK's deal with the EU.

GOV.UK Rules of origin for goods moving between the UK and EU

In relation to Brexit......

The UK-EU Trade and Co-operation Agreement (“TCA”) provides businesses with the benefit of tariff free and quota free trade in goods between the two trading blocs.

Many may not realise, however, that these benefits can only be reaped with effort on the part of importers and exporters. One task to be fulfilled is proving that the goods to be imported or exported have “originated” in the EU or UK.

Rules of origin relating to art - and trade between the UK and EU

I have found NOTHING in the articles I've searched online which refers specifically to art / artworks / art materials etc

EXCEPT for this question asked in the House of Lords - see below

This seems to say that artwork (at least) is not subject to any export tariff in trade between the EU and UK

EXCEPT for this question asked in the House of Lords - see below

This seems to say that artwork (at least) is not subject to any export tariff in trade between the EU and UK

A question was asked in the House of Lords with respect to the trade of art between the UK and the EU

QUESTION: |

ANSWER: (22 January 2021) Artworks classified in Chapter 97 of the Harmonised System (Works of art, collectors’ pieces and antiques) are currently eligible for import at zero tariffs under both the UK Global Tariff and the EU Common External Tariff. This means that businesses who trade artwork between the UK and EU do not need to comply with Rules of Origin under the Trade and Cooperation Agreement to export or import under zero tariffs. |

Other sources of information

REFERENCE:

- Wikipedia - Rules of Origin

- Institute of Government - Trade: rules of origin

- Institute of Export & International Trade - Rules of Origin - what you need to know

- LAWYERS

|

Banner image: Photo by Andrew Stutesman on Unsplash

|

ADVERT

|

ABOUT ART BUSINESS INFO. FOR ARTISTS

This website aims to provide a compendium of resources about the art business for artists. Please read "PLEASE NOTE"

It helps artists learn how to do better at being business-like, marketing and selling their art and looking after their financial security.

This website aims to provide a compendium of resources about the art business for artists. Please read "PLEASE NOTE"

It helps artists learn how to do better at being business-like, marketing and selling their art and looking after their financial security.

|

Copyright: 2015-2021 Katherine Tyrrell | Making A Mark Publications

- all rights reserved If you've got any suggestions for what you'd like to see on this website please send me your suggestion

|

PLEASE NOTE:

1) Content and the law change all the time. It's impossible to keep up with it if you're not working on the topic full time. 2) I research topics carefully. However, I am totally unable to warrant that ANY and/or ALL information is

|

3) Hence all information I provide comes without any LIABILITY whatsoever to you for any choices you make.

4) This website is FREE FOR YOU but not for me. Links to books are Amazon Affiliate links. Buying a book via this website means I get a very small payment which helps to fund and maintain this website. .I much appreciate any support your provide. Adverts are provided by Google AdSense - but the adverts do not mean I endorse the advertiser. |

- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING