- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING

What you need to know to ship (export) artwork internationally

for exhibition and/or sale

for exhibition and/or sale

|

FACTS: How to move art between countries is

|

Many artists exhibit their art internationally and many sell art internationally

|

WHAT THIS PAGE COVERS:

This section aims to tell you what you need to know - and references other sources of information.

This section aims to tell you what you need to know - and references other sources of information.

|

THE PAPERWORK: the really important documents:

1. Customs Compliance - Documentation Required - what you need to know re. paperwork you MUST make available if HMRC start inspecting your activities and compliance with Customs Regulations 2. How to produce an export invoice -

3. Trading with the EU: How to get an EORI Number (Economic Operator Registration and Identification) (re import/export involving EU Countries) an identification number which customs use to identify the sender and their parcels across all EU countries. 4. Customs Declaration Forms - and how to complete them properly. These can vary depending on the value of the art - and you MUST use the correct one. Plus these are going digital.....

5. Trade Tariffs and Export Commodity Codes You have to formally indicate to Customs - using the correct code - what is inside the parcel. FIND OUT:

|

TAXES / DUTY / VAT ON ART:

6. Customs Charges, Taxes, Import Duty & VAT: You cannot assume no duty or tax or VAT is payable at Customs.. You can however prepay any duty or tax due. AND artwork does NOT get out of Customs unless all relevant taxes have been paid

WHAT ELSE YOU NEED TO KNOW AND DO

BELOW I INDICATE WHAT THIS SITE DOES NOT DO |

The really essential thing you need to know about

shipping art internationally

is that

shipping art internationally

is that

NOTHING MOVES

UNLESS

YOU GET THE CUSTOMS PAPERWORK RIGHT!

and

Electronic customs data became mandatory

for some international destinations from the 1 January 2019

|

I CANNOT EMPHASISE THIS ENOUGH

I've known more than a few artists, art societies and art competitions where

The latest tweak is electronic customs forms - but not everywhere as yet. HMRC are also being much clearer about compliance checks Similarly if you want your art back after sending it to another country, you need to send it with the correct documentation for re-import. |

Leaving details off customs declarations can lead to delays, or can in some instances lead to your item being returned to sender or even seized by customs. Your goods may be seized if you don’t follow the rules. You may also be fined or prosecuted. |

Thank you so much for your informative, helpful blog. When I called shipping companies (4 times and a visit in person), no one would tell me where to get a Customs Declaration form which my new collector requires or even told me I could not get one until it was at customs. This was so frustrating and honestly, I do not think the people at the co. knew about the form or what is is and if they are answering questions about their international shipping service, they should. Thank you so much for Sharing your in depth knowledge on this!

Leslie P

What this site does NOT do

|

This site does NOT provide:

|

I recommend that you pay a professional for tax advice IF:

|

Please read this IMPORTANT DISCLAIMER

- I'm NOT LIABLE for any of the advice you find on this page. I'm just doing what many artists the world over do - trying to decipher and organise what official documentation says artists have to do - hence the very many references to official documentation! However just because it's on my website doesn't mean it's EITHER complete OR the most up to date documentation. But at least it gets you started in the right direction. and alerts you to some of the things you need to know and do....

- Remember only YOU are responsible for the international shipping and the choices YOU make - UNLESS you employ a dedicated professional service to do it for you for a fee..

#1. Customs Compliance - Documentation Required

Why you MUST know

(1) what you must know and (2) documentation you need to produce

to demonstrate Customs Compliance

Every country will be different - but the points below are likely to be present in most countries

(1) what you must know and (2) documentation you need to produce

to demonstrate Customs Compliance

Every country will be different - but the points below are likely to be present in most countries

You have an obligation to take reasonable care to get things right Providing fraudulent data on shipping documents to avoid duty or taxes is illegal. |

Customs Compliance is mandatory NOT optional in all countries.

|

In the UK - You may have to pay a penalty to HMRC if you’re found to have broken European Union and UK customs law on the import, export and holding or processing of goods under customs supervision. This includes, but is not limited to:

Doing things deliberately wrong can lead to a criminal investigation |

A Customs Compliance Check by HMRC in the UK may involve a visit to your business premises to:

Documents HMRC might ask for include:

|

HMRC carry out compliance checks to: |

REFERENCE:

|

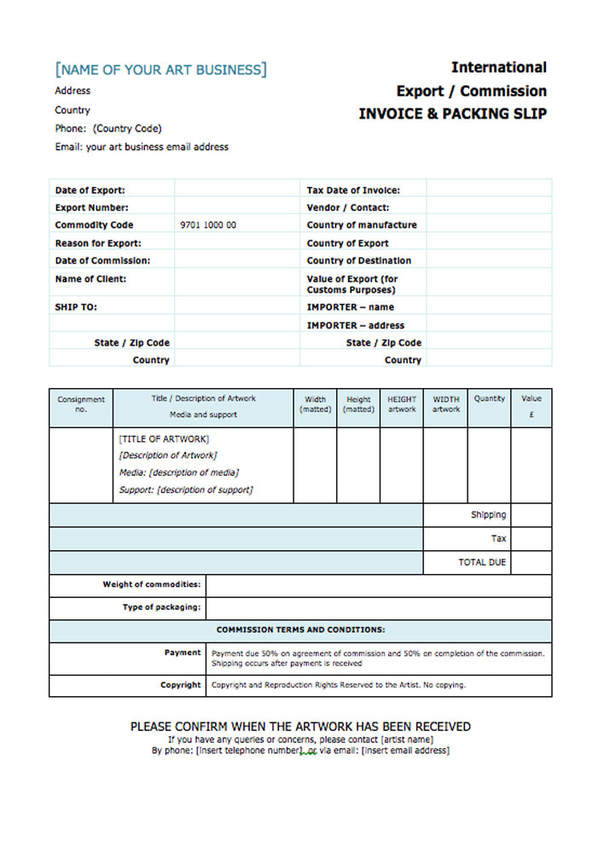

#2. How to produce an EXPORT Invoice

and why you also need an IMPORT invoice

for artwork exhibited internationally or being returned

for artwork exhibited internationally or being returned

|

If exporting or importing artwork outside the EU, you need:

|

|

An EXPORT INVOICE is REQUIRED for all artwork sent to a country outside a customs union (such as the European Union)

Below I explain all the items that need to be included.

This is the export invoice that I use - and I've had no problems to date. (download link below) You need to amend it to indicate whether it is commercial or a proforma invoice If you intend to re-import the art (eg sent for exhibition) then you need to produce BOTH an:

FREE INVOICE DOWNLOADS You can

|

| ||||||

IF YOU ARE SENDING ARTWORK (paintings/drawings) FOR EXHIBITION ONLY

Note that

Note that

- you MUST say "artwork is sent on approval for exhibition purposes only"

- the value of the artwork must match both the import and export papers

The commercial invoice the artist submits to customs through the shipper must include:

1. The harmonized tariff number (TARIC) or commodity code 9701100000 for “paintings, drawings and

pastels executed by hand.”

2. Title, medium and value of the artwork.

3. A sentence that states, “Artwork is sent on approval for exhibition purposes only. There is no commercial value and no commercial transaction.”

Instructions for International Shipments to an International Triennial Exhibition (no sales) at the Hunt Institute

SUMMARY of what an export and import invoice needs to contain

Artwork Information

|

Customs Information (ESSENTIAL)

|

|

You can read a DETAILED EXPLANATION of what’s required of an export invoice and packing slip in my blog post Exporting Art (Part 1): The Invoice

|

If the artwork is valued at more than £270 you MUST include the invoice with the customs declaration

|

|

Provenance: Recently I've been watching too many television programmes about establishing provenance! Plus I also saw some invoices recently for works sold by Paul Durand-Ruel in the nineteenth century and I was very impressed by the detailed description of the work. Hence I have now added this into the invoice I use!

Also Customs do not like items of value that lack a precise descriptions Remember however that the only things Customs and Shippers are typically interested in are:

Packages whose declared value is under $800 ($100 if being sent as a gift to someone other than the purchaser) will generally be cleared without any additional paperwork prepared by CBP. However, CBP always reserves the right to require a formal entry for any importation and generally exercises this option if there is something unusual about the importation, or if important documents such as an invoice or bill of sale do not accompany the item. |

You should attach an invoice for all commercial items. RECOMMENDATION: I recommend two EXPORT invoices

RECOMMENDATION: PLUS - for a RETURN journey - you also need AN IMPORT PROFORMA INVOICE

so that's three invoices in TOTAL! If you exhibit your artwork internationally, then you need to be able to get it back into the country. An IMPORT Invoice enables you to

|

HOW TO: write an international address correctly

|

Make sure you use the correct format of address for the country you are posting/shipping to.

Not all countries format their addresses in the same way. The REFERENCE section includes some resources which help you understand better how to format addresses correctly USE CAPITALS FOR ADDRESSES - it avoids confusion due to handwriting. USE A WHITE LABEL FOR THE ADDRESS - it helps people and machines to read it easily ALWAYS INCLUDE THE POST CODE OR ZIP CODE - most post is processed by machine and the code is needed to speed up the process You need to have a correct and clear names of

|

REFERENCE

International addresses

|

ADVERTISEMENT

#3. Trading with the EU: How to get an EORI Number

(Economic Operator Registration and Identification)

You need an EORI number to trade goods with countries outside the EU.

If you’re based outside the EU you need an EORI number to trade goods with the UK / EU

Get an EORI number

|

This section covers:

If you live/work within the EU you need an Economic Operator Registration and Identification (EORI) number to trade goods with countries OUTSIDE the EU.

If you live/work outside the EU you need an Economic Operator Registration and Identification (EORI) number to trade goods with countries INSIDE the EU. |

REFERENCE:

Official:

|

What is an EORI number - and what does it do?

Any business which imports or exports of goods into or out of the EU needs an EORI number to trade.

Businesses and people wishing to trade must use the EORI number as an identification number in all customs procedures when exchanging information with Customs administrations.

|

"EORI" stands for Economic Operator Registration and Identification.

An EORI number is a unique identification number which identifies who you are to Customs. It is irrelevant if the economic operator is

An EORI number is used for:

The EORI system started in 2009. It replaced the previous system of Traders Unique Reference Number (TURN) |

REFERENCE:

The following links are to official webpages about what the EORI is and how the EORI works within the EU Official:

|

What is the format of the EORI number?

|

The EORI number exists out of two parts:

You can check valid EORI numbers in the EORI online database |

UK EORI numbers start with the letters 'GB'. Most are then followed by a 12-digit number based on the trader's VAT number (eg GB123456789000). |

When and why do you need an EORI number?

|

If you live/work within the EU you need an Economic Operator Registration and Identification (EORI) number to trade goods with countries outside the EU.

It is irrelevant if the economic operator is

|

REFERENCE:

Official:

|

How do I get an EORI number?

|

You need to apply to the relevant taxation and customs authority

|

REFERENCE:

|

#4. CUSTOMS DECLARATION FORMS

Customs authorities around the world require international mail and parcels of value arriving in their country

to have the required customs declarations.

So make sure you've completed the necessary forms.

to have the required customs declarations.

So make sure you've completed the necessary forms.

Note: It is important to know that foreign shipments that are not accompanied by a U.S. Customs and Border Protection declaration form and an invoice may be subject to seizure, forfeiture or return to sender.

Internet Purchases | US Customs & Border Protection (my bold)

|

Customs declarations are required for all commercial items. This means

To complete customs documentation you MUST know and state the relevant trade commodity tariff code - see next section |

There are generally two forms - for lower and higher value art

FOR EXAMPLE IN THE UK:

|

HOW TO: Complete Customs documentation in the EU / UK

Transport of art within the EU

|

Transport OUTSIDE the EU / UK

|

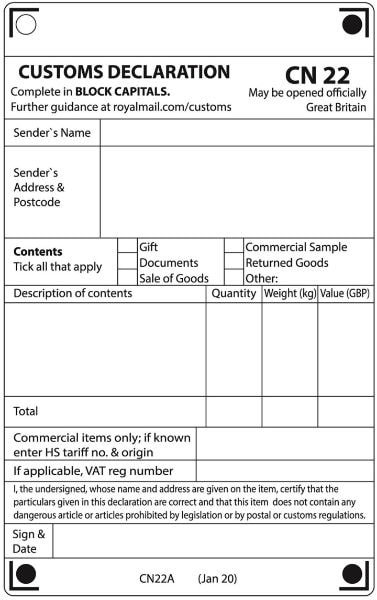

Hint: To speed a package through CBP examination at a port's International Mail Branch, the seller should affix a completed CN 22 or CN 23 (U.S. Customs and Border Protection Declaration Form) to the outside of the package. This form may be obtained at local post offices worldwide.

Internet Purchases | US Customs and Border Security

Form CN22 - for items up to the value of £270

All items with contents up to the value of £270 must have a signed and dated Customs declaration form CN22 attached to the front.

Royal Mail - Help with Customs

What the CN22 form looks like may vary from country to country - but should have the same number i.e. CN22 or 23

|

This is the NEW form CN22 which is an International Customs Declaration Form (Great Britain) for items valued at less than £270. You can obtain the form

CN22 - You must also declare whether the item is:

|

REFERENCE:

- Customs Forms | Post Office

- Help with customs and sending items abroad | Royal Mail - If you are sending items using International Standard and intend to purchase postage at a Post Office® branch, please get your CN22 at the same time as it will include a unique barcode.

- To minimise adverse environmental impact, existing stocks of the 'old style' CN22 labels can still be used.

- Royal Mail provides help with forms - DOWNLOAD YOUR CUSTOMS FORMS from below

Fill out your customs label

If you’re sending to a country outside the EU, you need to apply a customs declaration form to your package. They’re available online or in a Post Office® branch.

- For items with a value up to £270, you will need customs form CN22pdf, 394.05 KB.

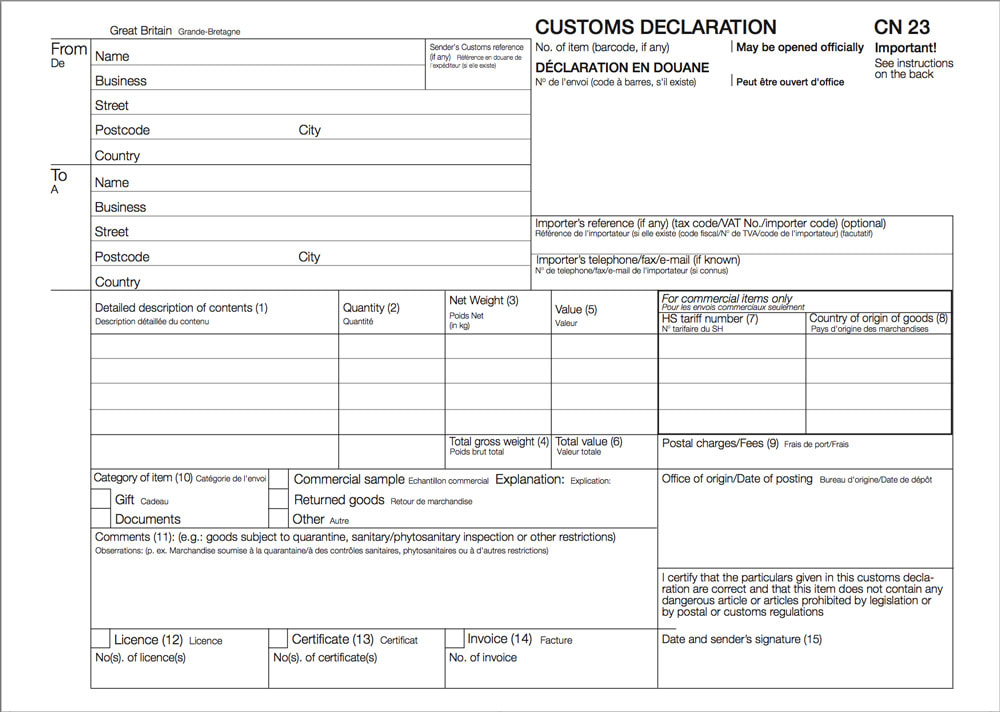

- For items with a value over £270, you will need customs form CN23pdf, 227.98 KB and clear plastic wallet SP 126, also available at any Post Office® branch.

Customs Forms | Royal Mail Interantional Track and Trace

Form CN23 - items valued over £270

CN23 is for artwork valued at over £270. It requires a lot more information.

What it looks like can very from country to country - but it should still include all the required information

What it looks like can very from country to country - but it should still include all the required information

The information required is as follows

The form must be attached to the parcel so that it is transparent to Customs that the form has been completed

- General descriptions are not permitted. Give a detailed description of each article in the item, e.g. “framed oil painting”.

- Give the quantity of each article and the unit of measurement used.

- Give the net weight of each article (in kg).

- Give the total weight of the item (in kg), including packaging, which corresponds to the weight used to calculate the postage.

- Give the value of each artwork

- Give the total value of all artwork in the package - indicating the currency used (e.g. GBP for pounds sterling).

- HS tariff number (6-digit) must be based on the Harmonized Commodity Description and Coding System developed by the World Customs Organization.

- The “Country of origin” means the country where the goods originated, e.g. were produced/manufactured or assembled. Senders of commercial items are advised to supply this information as it will assist Customs in processing the items.

- Give the amount of postage paid to the Post for the item. Specify separately any other charges, e.g. insurance.

- Tick the box or boxes specifying the category of item.

- Provide details if the contents are subject to quarantine (plant, animal, food products, etc.) or other restrictions.

- (Licence) and

- (Certificate) If your item is accompanied by a licence or a certificate, tick the appropriate box and state the number.

- (Invoice) You should attach an invoice for all commercial items.

- Your signature and the date confirm your liability for the item.

The form must be attached to the parcel so that it is transparent to Customs that the form has been completed

Any item sent with a value in excess of £270 must have a fully completed Customs declaration form CN23. This should be attached using the plastic wallet available from any Post Office® branch.

Royal Mail - Help with Customs

|

Rated an average of 4.9 out of 5 stars by 42 customers

|

Rated an average of 5 out of 5 stars by 6 customers This envelope can be used to include your CN23 and any other relevant documentation which Customs need to see. These envelopes are:

|

REFERENCE:

Forms are available to download from this link

Forms are available to download from this link

- Help with Customs and sending items abroad | Royal Mail - important information on sending and receiving items aboard. Detailed guidance on which forms to use when sending to different countries

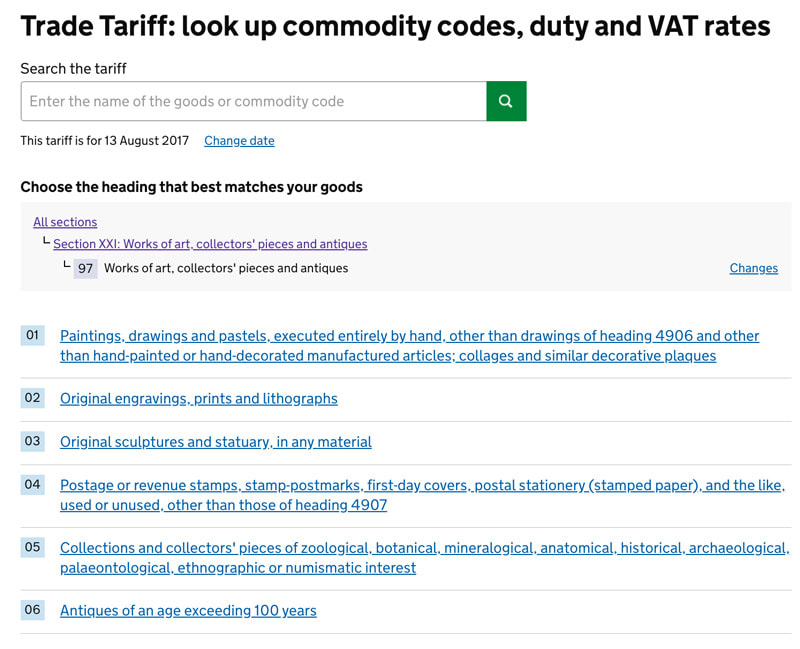

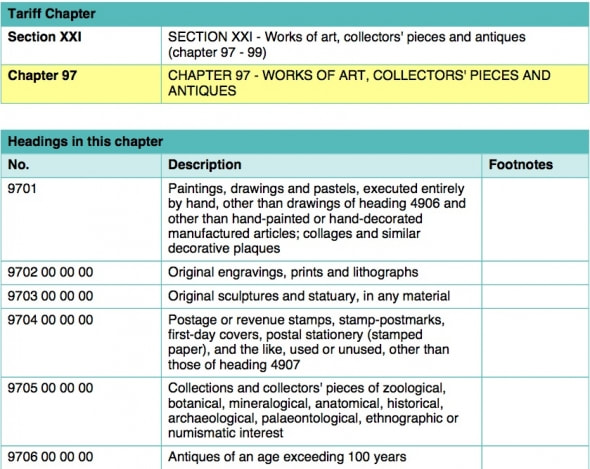

- Trade Tariff: look up commodity codes, duty and VAT rates | Gov UK - Commodity codes classify goods for import and export so you can: fill in declarations and other paperwork; check if there’s duty or VAT to pay; find out about duty reliefs

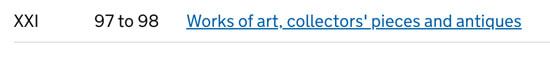

- Trade Tariff | Section XXI: Works of art, collectors' pieces and antiques | Gov. UK - SECTION XXI - Works of art, collectors' pieces and antiques (chapter 97 - 99)

Heading 9703 does not apply to mass-produced reproductions or works of conventional craftsmanship of a commercial character, even if these articles are designed or created by artists.

Note 3 Trade Tariff | Section XXI: Works of art, collectors' pieces and antiques | Gov. UK

The ATA Carnet

The ATA Carnet is used for artwork being shipped for EXHIBITION ONLY.

That means "exhibition ONLY" i.e. not for sale

That means "exhibition ONLY" i.e. not for sale

|

In the UK, HM Revenues and Customs define an ART carnet as follows...

|

The ATA carnet is an international Customs document that can be used in different countries around the world to cover temporary use of goods without payment of Customs charges." |

|

Item 18 states an ATA is available for:

"Works of art, collectors items and antiques imported for the purposes of exhibition, with a view to possible sale" |

A carnet can be used by private travellers or businesses. When a carnet is issued, the person who can use it will be named on the front cover of the carnet, this person is the ‘holder’. The carnet can be used by the holder or a representative. The representative is named in box B of the carnet or by a letter of authorisation. |

The HM Revenue & Customs - ATA and CPD Carnets notice explains how ATA carnets can be used to:

One class of relief relates to artwork - you can read about this in ATA and CPD Carnets (Acrobat PDF, 250KB)

However they can be quite difficult to obtain and they are not essential if you do the paperwork for Customs properly.

- temporarily export goods for use outside the EU

- claim relief under Temporary Admission on non-EU goods imported for temporary use in the UK

- cover transit of goods through certain countries en route to countries where they will be temporarily used.

One class of relief relates to artwork - you can read about this in ATA and CPD Carnets (Acrobat PDF, 250KB)

However they can be quite difficult to obtain and they are not essential if you do the paperwork for Customs properly.

REFERENCE:

- ATA Carnet - Wikipedia, the free encyclopedia - The ATA Carnet is an international customs document that allows the holder to temporarily (up to one year) import goods without payment of normally applicable duties and taxes, including value-added taxes. The Carnet eliminates the need to purchase temporary import bonds. So long as the goods are re-exported within the allotted time frame, no duties or taxes are due.

- London Chamber of Commerce and Industry - ATA CARNET - 'PASSPORT FOR GOODS'

- ATA Carnet | Trust the Experts - Detailed information, Alerts and Updates about the ATA Carnet international customs document is found on these pages. Live Customer Service from Carnet Specialists is also available using Click to Chat and Click to Call.

- Business support, information and advice | Business Link - Export Procedures - ATA and CPD (Carnet de Passages en Douane) - ATA and CPD (Carnet de Passages en Douane) carnets provide for goods to be taken temporarily into or out of the European Union (EU) for purposes such as exhibiting at a trade fair without having to complete the customs declarations and formalities normally required. Their use is not mandatory but where they are available they simplify customs clearances in dispatching and receiving countries that are party to the ATA carnet or Istanbul Conventions.

- Checklist Temporary use without an ATA Carnet | Touring Artists - what you need to export and reimport goods without an ATA Carnet (the example used if for Germany - but the principles are the same for other EU countries)

HOW TO: Complete Customs documentation in the USA

It's important to note that the US Customs and Border Protection website is absolutely dreadful.

It's almost impenetrable due to less than helpful navigation, masses of dead links,

the prevalent use of acronyms without explanation, and a search facility which cannot produce basic forms!

If you happen upon a helpful page it's often by accident.

These are their Tips for New Importers / Exporters

This is Importing into the United States A Guide for Commercial Importers (Last revised 2006)

This is their guidance on responsibilities and liabilities re Internet Purchases

It's almost impenetrable due to less than helpful navigation, masses of dead links,

the prevalent use of acronyms without explanation, and a search facility which cannot produce basic forms!

If you happen upon a helpful page it's often by accident.

These are their Tips for New Importers / Exporters

This is Importing into the United States A Guide for Commercial Importers (Last revised 2006)

This is their guidance on responsibilities and liabilities re Internet Purchases

EXPORT: Customs forms are required if an items weighs more than 16 ounces and sent via USPS mail to an international destination.

The US Postal Service (USPS indicates that the following forms are required for export.

The US Postal Service (USPS indicates that the following forms are required for export.

123.1 USPS-Produced Customs Declaration Forms

123.11 GeneralAs required under 123.6, only four customs declaration forms are used for international mail:

- PS Form 2976, Customs Declaration CN 22 — Sender’s Declaration.

- PS Form 2976-A, Customs Declaration and Dispatch Note — CP 72.

- PS Form 2976-B, Priority Mail Express International Shipping Label and Customs Form. Note: For international mail, PS Form 2976-B is used only for Priority Mail Express International items. ........

- PS Form 2976-R, USPS Customs Declaration and Dispatch Note. This form is available only as a hard copy that customers use as a worksheet that they must present with their mail item at a USPS retail service counter. The retail associate enters the information into the retail system or Customs Form Online (see 123.742), and then generates and prints the appropriate customs form to affix to the mail item. Customers cannot use PS Form 2976-R as a stand-alone customs form.

IMPORT: For goods being imported into the USA, this Customs and Border Security Statement indicates

- all the information items which must be covered and

- the level of detail required

U.S. Customs and Border Protection Declarations

All paperwork for sending packages internationally has a section for providing CBP information. A U.S. Customs and Border Protection Declaration is a form obtainable at most foreign post offices. This declaration form should include a full and accurate description of the merchandise, and should be securely attached to the outside of your shipment. Declaration forms vary from country to country, and they don't all ask for the information required by the U.S. Customs and Border Protection.

You should ask the seller to provide the following information, whether or not it is asked for on the paperwork.

- Seller's name and address. Description of the item(s) in English (a legal requirement). For example, antique silver teapot, silk kimono, 18-karat gold rope necklace. It is very important that this information be detailed and accurate. What is described here will determine the classification number and duty rate that Customs assigns the item when it arrives in the United States. If this information is inaccurate, you could end up paying the wrong duty rate for what you purchased. If it is inaccurate enough to seem deliberately misleading -- keep in mind that CBP does randomly inspect packages -- your goods could be seized and you may be assessed a fine.

- Quantity of each type of item being shipped. For example, two watches (14-karat gold, 17 jewel), one leather purse.

- Purchase price in U.S. dollars. Provide both the unit price, and if more than one unit was purchased, the total value for all like items. Fudging or miscalculating the price paid for goods is a bad idea. Many sellers offer to misrepresent costs in an effort to save the purchaser from having to pay duty, but this is illegal. Others sellers are wary of package handlers and do not want them to know how valuable something may be, which could result in its theft. The most common legal precaution against theft is to insure the package when sending it. You should discuss insurance options with your seller, keeping in mind that misrepresenting the value of an item on the Customs declaration is illegal.

- Weight of the item(s).

- Country of origin of the product itself. Be aware that this is not necessarily the country where the item was purchased.

Internet Purchases | Customs and Border Security

Note that HANDWRITTEN FORMS ARE NO LONGER ACCEPTABLE

Handwritten Customs Declaration Forms are No Longer Acceptable

As of March 6, 2020, the United States Postal Service® will no longer accept any article bearing a handwritten customs declaration form.

Customers must use PS Form 2976-R, USPS Customs Declaration and Dispatch Note, instead.

Forms | United States Postal Service

Also use this form on a First-Class Mail International mailpiece or the Priority Mail International Flat Rate Envelope if ANY of the following applies:

- The mail weighs 16 ounces or more (4 pound maximum weight limit);

- The mail exceeds ¾ inch thick; or

- The mail contains dutiable contents."

VALUED UNDER/ OVER $2,500

If entering works of art commercially at a land border and the value is under $2500, use CBP Form CF-7523. [DEAD LINK?]

If the item is valued over $2500 formal entry through a Customs Broker and ACE manifest is required.

Personal importation can be done by an oral declaration at a Port of Entry.

Importing personal and commercial original works of art, paintings, drawings, pastels, collages, decorative plaques, lithographs, original prints and sculptures ( Article-360) | US Customs & Border Protection (September 2019)

In the USA Artwork is considered to be

"Examples of items that do not qualify as documents - rather, they are considered merchandise, so the sender is required to apply a customs declaration form and declare a value"

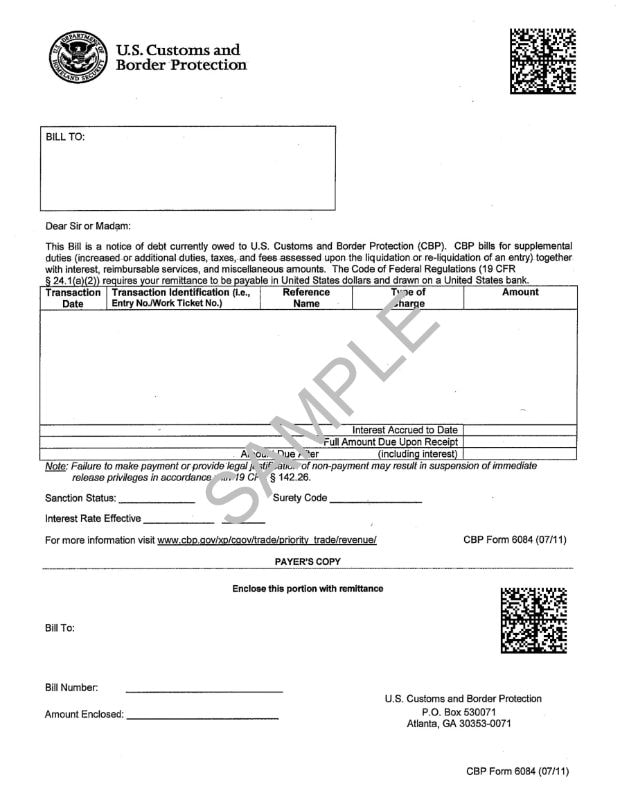

CBP FORM 6084

This is sent by Customs and Border Security if amounts are owed - in order to release an item from Customs

CBP’s bill form (Form 6084) includes data matrix coding. This coding captures the most critical elements of the bill including amounts owed (total amount as well as the amounts associated with each type of charge such as duty, merchandise processing fee etc.), billed party name and address, bill date, entry date, and port of entry.

This is sent by Customs and Border Security if amounts are owed - in order to release an item from Customs

CBP’s bill form (Form 6084) includes data matrix coding. This coding captures the most critical elements of the bill including amounts owed (total amount as well as the amounts associated with each type of charge such as duty, merchandise processing fee etc.), billed party name and address, bill date, entry date, and port of entry.

REFERENCE:

- Importing personal and commercial original works of art, paintings, drawings, pastels, collages, decorative plaques, lithographs, original prints and sculptures - How is duty determined for personal and commercial imports of original works of art, paintings, drawings, pastels, collages, decorative plaques, lithographs, original prints and sculptures?

- Bill Payments | Customs & Border Protection

- Ports of Entry | Customs & Border Protection

- USPS - International Mail Manual - Mailing Standards of the United States Postal Service International Mail Manual

- USPS - Customs Forms International shipments may be subject to Customs examination in the destination country. Sign in or sign up to complete Customs forms online to declare the contents and value of your shipment, or just select and print an online Customs forms.

- Index of Countries and Localities - USPS Postal Explorer > International Mail Manual > Index of Countries and Localities

- 123 Customs Forms and Online Shipping Labels - USPS - IMM - International Mail Manual - ContentsPostal Explorer >IMM - International Mail Manual > 1 International Mail Services > 120 Preparation for Mailing > 123 Customs Forms and Online Shipping Labels

- Customs Declaration CN22 - Sender's Declaration Instructions - Summary states:

#5 TRADE TARIFFS & EXPORT COMMODITY CODES

|

You need to use these codes to

|

You also need to refer below to

CUSTOMS CHARGES, RATES AND TARIFFS - because you cannot assume no duty or tax is payable at Customs. |

|

Understand the Tariff Codes

A code has six digits

|

LOOK UP the Right Code to Use

In the UK you can confirm the right code using this page on the .gov.uk website - Trade Tariff: look up commodity codes, duty and VAT rates (look for Chapter 97)

|

|

The Harmonized Commodity Description and Coding System has been developed by the World Customs Organization to help speed up parcels and packages through Customs - and you MUST use the correct commodity code.

200+ member countries use this system - but not all countries do. |

REFERENCE:

|

The images below relate to this code classification model to ART as detailed on the UK Government website.

TRADE TARIFFS - Commodity Codes for Art

For most paintings and drawings,

the tariff commodity code which MUST be displayed on Customs paperwork is

9701.10.0000

NOTE: Prints and Sculpture have different commodity codes - see below

the tariff commodity code which MUST be displayed on Customs paperwork is

9701.10.0000

NOTE: Prints and Sculpture have different commodity codes - see below

|

Commodity Tariff Codes are used to

|

They are:

|

Printed or illustrated postcards;

printed cards bearing personal greetings, messages or announcements, whether or not illustrated,

with or without envelopes or trimmings

49090000

printed cards bearing personal greetings, messages or announcements, whether or not illustrated,

with or without envelopes or trimmings

49090000

Printed, books, brochures

Printed books, brochures and similar printed matter, in single sheets, whether or not folded

(excl. periodicals and publications which are essentially devoted to advertising)

49019900

Printed books, brochures and similar printed matter, in single sheets, whether or not folded

(excl. periodicals and publications which are essentially devoted to advertising)

49019900

Calendars of any kinds, printed, incl. calendars blocks

49100000

49100000

ornamental ceramics

Below there is an explanation of how to use the Trade Tariff Commodity Codes for exporting art

SEE THE BOX BELOW FOR HOW TO USE THEM for importing and exporting art

SEE THE BOX BELOW FOR HOW TO USE THEM for importing and exporting art

Commodity codes classify goods for import and export so you can:

* fill in declarations and other paperwork

* check if there’s duty or VAT to payTrade Tariff: look up commodity codes, duty and VAT rates | GOV UK

- * find out about duty reliefs

How to use the Trade Tariff Commodity Codes for importing and exporting art

Available from UK Trade Tariff – CHAPTER 97 – WORKS OF ART, COLLECTORS’ PIECES AND ANTIQUES

EXPORT AND IMPORT CODE FROM/TO UK: Export Codes and Import Codes - for export (sending art to a country outside the EU) or import (receiving art from a country outside the EU) as per The Harmonized Commodity Description and Coding System developed by the World Customs Organization

Mark your Customs Declaration with Export Commodity Code:

EXPORT TO ANOTHER COUNTRY (in the EU): Export Codes for artists based outside the UK

Mark your Customs Declaration with Export Commodity Code:

- 97 01 100000 for original paintings, drawings and pastels executed by hand

- 97 01 900000 for handmade collages & similar decorative plaques

- 97 02 000000 for original engravings, prints and lithographs

- 97 03 000000 for original sculptures and statuary, in any material

- 49 11 910090 for Photographs, printed, limited editions

EXPORT TO ANOTHER COUNTRY (in the EU): Export Codes for artists based outside the UK

- as above

When is art not art for the purposes of commodity codes?

|

Do make sure you pay close attention to what is and is not defined as artwork!

What is Art? | Taxation is a summary of an important case where HMRC had asserted that an installation when disassembled for transport was not art. However it was trying to charge VAT at the higher rate but on the value of the artwork as opposed to the value of the materials which comprised the installation. It's an important case and relevant to the international transport of art and, in particular, sculpture and installations and any oversized artwork which comes apart. |

At trial, HMRC argued that the works were not art when disassembled into their various electrical component parts and crated for shipping..... The tribunal rejected HMRC's argument that whilst the installations may be works of art when assembled, they were not when unassembled or disassembled and packed into crates at the time of importation. The tribunal "[regarded] it as absurd to classify any of the works as components ignoring the fact that the components together make a work of art". ' |

#6. CUSTOMS CHARGES, RATES, TARIFFS & VAT

You cannot assume no duty or tax or VAT is payable at Customs.

You can however prepay any duty or tax due.

You can however prepay any duty or tax due.

Liability for duty and tax on sale of artwork

|

Art sold to a client living in another country is liable for all relevant duty and tax

(unless none is payable e.g. artist in EU country sells to collector in a different EU Country). The principle is that the buyer pays all relevant duty and tax - because the amount that is payable is dictated by where he or she lives and what gets charged when importing art to that country. Any attempt to avoid the payment of all relevant taxes is likely to incur severe and expensive penalties |

VERY IMPORTANT

If your work is available for sale to anybody living anywhere in the world, you MUST state that the prices of art on your website (or third party site) are subject to the addition of any relevant duty and taxes on exporting permanently outside your country and importing to another. |

Customs Charges & Tax

|

Customs Charges are based on valuation of the goods and agreed rates for trade and can comprise:

Countries tend to have trade agreements which mean at least some goods imported from some countries are charged a lower tariff. These agreements tend to be reciprocal rather than one way.

You can look up tariffs for the fine art commodity codes using the World Trade Organisation's Tariff Download Facility - this indicates those with a significant duty on imported art.

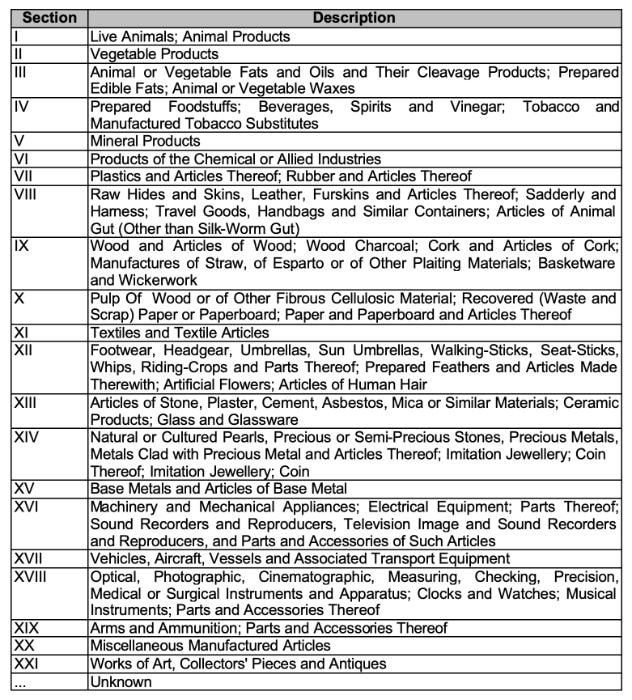

WTO provides the Section Headings of the Harmonized System (summarised version in the image) Works of Art are in Section XXI Works of Craft may be in Other Sections |

Country of import

|

Valuation for duty and tax payable

|

Pricing the art

There is a global crackdown on e-traders and others deliberately mispricing goods in order to avoid tax.

|

You should NOT:

So, for example, that fact that a commissioned artwork might be a gift from a husband to his wife does NOT make it a gift from you in terms of the value of the item and the sum you have received for the commission. |

When are goods exempt from tax?

In many countries, overseas goods are free from customs duty or import value-added tax if they are personal gifts for special events, like weddings or birthdays. To benefit from the relief, the goods must typically be worth less than $50. |

Transfer Pricing: This generally relates to the transfers of goods and transactions between connected parties. There is a wealth of tax guidance about this. The internationally recognised ‘arm’s length principle’ and the OECD (Organisation of Economic Co-operation and Development) Transfer Pricing Guidelines governs most of what should happen i.e. there are no favourable valuations to a company simply because transactions are between

Returned Goods

Notices about how this works in your country will vary.

In the UK Notice 236 Returned Goods Relief details how this works (note also this gets updated on a periodic basis so be sure to click the link to make sure you are working with the latest version.

See below for how this applies to artwork re-imported after an exhibition in another country within 2 years - it's one aspect which makes life a lot simpler!

In the UK Notice 236 Returned Goods Relief details how this works (note also this gets updated on a periodic basis so be sure to click the link to make sure you are working with the latest version.

See below for how this applies to artwork re-imported after an exhibition in another country within 2 years - it's one aspect which makes life a lot simpler!

VAT (including on the Distance Selling of Art)

Within the EU, unless an exemption applies, the importer of art, antiques and collectibles is liable to pay import VAT at the rate determined by individual countries.

For detailed information on VAT relating to cross-border sales see below and VAT for Artists and the section on this topic

If you are re-importing art after an exhibition - see Liability for duty and tax on art re-imported after an exhibition below.

REFERENCE:

Various articles discussing the challenges and pitfalls of importing and exporting art - and the implications in terms of dealing with Customs and Tax

Various articles discussing the challenges and pitfalls of importing and exporting art - and the implications in terms of dealing with Customs and Tax

- VAT for non-UK artists and UK exhibition organisers | Making A Mark - an introduction to recent changes in Value Added Tax and VAT registration for both artists living outside the UK who want to exhibit and sell their art in the UK; and those selling art by overseas artists in the UK i.e. the managers of art galleries and art fairs, the Executive Committees of Art Societies and the organisers of Art Competitions.

- Artists use 97 Shipping Codes on Art to avoid VAT and Customs Holds | Art Marketing Resources - an artist talks about how to avoid artwork getting stuck at Customs

- Will I be liable to Pay Duty on my Artwork? | Artfinder

- 11 Tax Secrets Every Art Collector Needs to Know | Artsy - from an American perspective - including a comment on the range of sales and use tax in the USA

Articles about exporting / importing / shipping art

IMPORT / EXPORT: Articles by Professionals / Professional Organisations

- Importing and Exporting Your Work | Visual Artists Ireland - provides a helpful guide to the issues involved with transporting work internationally

- Exporting Art - A Guide for Artists at International Exhibitions and Commissions | Peter Wennersten (IAA Sweden) - a comprehensive manual to the export of art - including temporary export for exhibitions

- Advice for Artworks sent from outside EU | London Biennale - includes precise instructions for couriers and an invoice template

- Importing Art into the UK | Brebners - outline advice from a firm of accountants looking at the duty and VAT on importing art into the UK

- VAT and Customs Duties. Bringing goods into the UK – A brief guide | Marcus Ward - not specific to art but relatively simple and accessible

- Touring Artists - an information portal for artists and creatives working internationally, provides comprehensive information on visas/residence, artist status and contracts, transport/customs, taxes, social security, other insurances, and copyright. (The focus tends to be on matters relating to Germany)

- New Rule on Cargo Is Shaking Art World | New York Times - what happens when the Transportation Security Administration mandates all items shipped as cargo on commercial passenger airplanes has to go through airline security screening.

Below I indicate what I believe (as in I cannot keep up to date)

the situation is on custom tariffs for the UK, USA and the EU

the situation is on custom tariffs for the UK, USA and the EU

IMPORTING art to the UK

Your goods will not be released by customs until you’ve paid all duty and UK VAT.

Starting to import from non-EU countries

|

UK Customs duties on IMPORTS are made up of 2 components:

Duty relief schemes - temporary admission scheme.

|

REFERENCE:

|

IMPORTING art to the European Union (EU)

In some EU countries, the standard rate of import VAT applies.

- Within the EU, the standard rate of VAT varies between 15% and 25%.

- In some EU countries, a reduced rate of import VAT applies. The reduced rate varies by EU country between 5% and 18%.

- If an exemption applies, no VAT is due at the time of importation.

IMPORTING art to the USA

If you lower the valuation of art intended for sale on the entry documents - in order to avoid tax - you are committing a felony.

Original works of art (i.e. paintings, drawings, pastels, collages and decorative plaques) with or without their frames are duty-free under Chapter 97 in the Harmonized Tariff Schedule (HTS).

Importing personal and commercial original works of art, paintings, drawings, pastels, collages, decorative plaques, lithographs, original prints and sculptures ( Article-360) | US Customs & Border Protection (September 2019)

|

The USA has

There are special rules for Trade Shows In order to ship/import merchandise into the US, customs requires

An informal entry is the entry of goods valued under 2500US$ and does not need to be cleared by a customs bond as it is designated for mostly personal importations. |

REFERENCE:

|

What do I need to know about exhibiting a product, bringing or shipping supplies for a Trade Show in the U.S.?

If you are traveling into the U.S. to exhibit a product at a Trade Show/Fair, the following is a checklist of recommendations useful for the entry of the items:

- Official documentation date and location of the Trade Show

- Confirmation that you are an exhibitor

- Documentation indicating value of items

- Mark items "Not for Sale" or mutilate the items

- Contact the Port of Entry prior to travel

- Complete CBP 7523 "Entry and Manifest of Merchandise Free of Duty" (For NAFTA items only).

- Check with the government agency that regulates your product for any possible restrictions or required documentation

- Obtain the HTSUS code for your items

If shipping supplies and/or the value is over $2500, aTEMPORARY IMPORTATION UNDER BOND (TIB) or CARNET is the best course of action. This applies to display booths or other items not remaining in the U.S. beyond your intended visit.

Trade Shows - exhibiting a product/ booths | US Customs and Border protection

INTERNET PURCHASES

Customs & Border Protection provide Internet Purchases guidance to those seeking to import goods purchased on the Internet into the USA from outside its borders

Customs & Border Protection provide Internet Purchases guidance to those seeking to import goods purchased on the Internet into the USA from outside its borders

Checklist

Keep the following questions in mind before you buy something from a foreign source. The answers will have far-reaching CBP implications (explained below) that could influence your decision to buy.

- - Can the goods be legally imported? Are there restrictions on, or special forms required, for your purchase's importation?

- - Are you buying the item(s) for your personal use or for commercial purposes?

- - Will you be responsible for shipping costs? If so, you should discuss with the seller how your purchase will be shipped. The choices are freight, courier service or international postal service. If you're not careful, transportation and handling costs could far outweigh the cost of your purchase. Sometimes, the seemingly cheaper methods can be more expensive in the long run because they are more susceptible to theft, misdeliveries and logistical problems.

- - You should discuss with the seller what the exact delivery arrangements will be. If the seller does not make arrangements for postal or door-to-door delivery, you will either need to hire a customs broker to clear your goods and forward them on to you, or go the port of entry and clear them yourself.

- - Can you trust the seller to provide accurate information about the item being shipped in the Customs section of the shipping documents? Giving misleading or inaccurate information about the nature of the item and its value is illegal. And it is the importer - YOU - who could face legal action and fines for this violation!

TAX ON IMPORTING ART FOR EXHIBITION AND SALE

VAT on Art Imported to the EU area

- for sale at art fairs, art competitions, juried and gallery exhibitions

Non-established taxable persons (known as NETPs e.g.international artists who do not live in the EU) who are IMPORTING art for sale at art exhibitions (for art competitions or otherwise) in the EU need to know about VAT and how it works.

- Artists without a UK residence must register for UK VAT and supply a UK VAT number before they can sell works of art in an art exhibition or art gallery in the UK.

- Artists entering artwork FOR SALE in art competitions or juried exhibitions in the UK MUST take full responsibility for all costs, including any import customs charges and duties payable - and all transport costs (i.e competitions do not pay for transport or customs charges!)

|

This means that artists

In principle this means they have to register for VAT with HM Customs and Excise (can take up to 4 weeks) prior to importing the art. |

|

Liability for duty and tax on art re-imported after an exhibition

Relief from customs charges can be available if it is purely exported for exhibition and then re-imported unchanged by the artist - but there is a time limit on how long the art can be out of the country.

If you are importing artworks for an exhibition they are subject to duty and VAT relief as long as they are exported within 2 years.

Importing art into the UK - Brebners

|

In brief and in summary (and without liability) "exhibits for galleries or museums" are eligible for relief from duty if reimported without alteration after an exhibition.

|

UK Trade Tariff: relief from customs and excise duties and VAT sets out the reliefs available to those exporting art from the UK

The goods must be re-imported in an unaltered state, apart from any work that may have been required to maintain the goods in working order. Any work done must not have upgraded the goods to a higher specification or increased their value. Notice 236: Returned Goods Relief (Last updated: 26 January 2018)

This explains how to re-import commercial goods to the EU and obtain total or partial relief from customs duty, VAT and CAP charges. |

ADVERT

Size, Weight and Content Restrictions and Prohibitions (International)

|

Check information which relates to

Information is available as to what restrictions and prohibitions are employed by Royal Mail and Parcel Force within the UK and for international post. Bear in mind prohibitions on what can be sent internationally tends to be identical across the world. Prohibitions apply in both the sending and receiving countries and any parcel sent needs to be compliant with both |

REFERENCE:

|

ABOUT ART BUSINESS INFO. FOR ARTISTS

This website aims to provide a compendium of resources about the art business for artists. Please read "PLEASE NOTE"

It helps artists learn how to do better at being business-like, marketing and selling their art and looking after their financial security.

This website aims to provide a compendium of resources about the art business for artists. Please read "PLEASE NOTE"

It helps artists learn how to do better at being business-like, marketing and selling their art and looking after their financial security.

|

Copyright: 2015-2021 Katherine Tyrrell | Making A Mark Publications

- all rights reserved If you've got any suggestions for what you'd like to see on this website please send me your suggestion

|

PLEASE NOTE:

1) Content and the law change all the time. It's impossible to keep up with it if you're not working on the topic full time. 2) I research topics carefully. However, I am totally unable to warrant that ANY and/or ALL information is

|

3) Hence all information I provide comes without any LIABILITY whatsoever to you for any choices you make.

4) This website is FREE FOR YOU but not for me. Links to books are Amazon Affiliate links. Buying a book via this website means I get a very small payment which helps to fund and maintain this website. .I much appreciate any support your provide. Adverts are provided by Google AdSense - but the adverts do not mean I endorse the advertiser. |

- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING