- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING

|

Did you know you can set up a budget account to spread your UK tax payments to HMRC? Do you know how to budget for tax when your income as an artist is highly variable? This post covers:

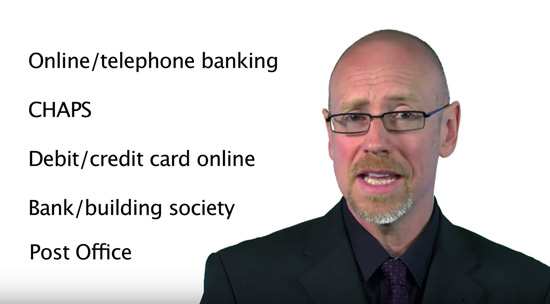

How to pay tax and NI to HMRCBelow is a video which highlights:

If you've always paid the same way you might find this very helpful and will change the way you make your payments. The video is part of a series produced by HMRC to help people understand the different stages of the tax process. Click Self Assessment Help and Deadlines to see the entire list of videos available Budget for your tax billThe main problem for a lot of artists is that their income can be very variable. That's why a lot of artists like to generate a steady income stream from something like teaching to reduce the stress of not knowing when and if you are going to earn income. Three approaches I know are used by a number of artists to reduce stress about tax payments are as follows 1. Regular savings Of course another way to set up a budget account is to pay a regular sum into a savings account each month - rather than an HMRC budget account! You can opt to take a holiday from making a regular saving if you have an expensive month. However the principle is that you get used to putting money away to meet your tax bill on a regular basis. That is something that is especially important to do if your art business suddenly moves up a gear and you start making a lot more money from your art. You also need to change your habits in relation to how much you save! You then pay your tax bill using the resources in the dedicated tax savings account. That way you also get a moderate amount of interest on the balance as it accumulates. 2. Regular % top slice of all income received If you generate enough income each year to pay tax then you will be left at the end of the year with a big lump sum to pay in one or two payments in January and July after the end of the tax year (i.e. 10 and 15 months after the end of the tax year). This is a different approach to creating a savings fund for the tax payment. What you do is take an automatic percentage based top slice from EACH receipt of a fee or payment for sales of your art. That is then set aside in a dedicated tax savings account. It can take a bit of time to work out from payments received what the percentage should be that you deduct deduct for tax after you set aside for a figure for business expenses and your pension These are the deductions you need to make before you arrive at the net income you actually get to enjoy or use for living expenses. If your income is variable it's very likely that the percentage may also vary with your gross and net income for the year. For example, if you start making a lot of money your taxable income could move into the top rate tax band and you then need to put aside more for tax. One way of working it out is to look at past tax years and work out what percentage you would have needed to save to hit the target for the tax bill payments after the end of the tax year. If you're not too good with numbers you probably know somebody who can do this for you. Or you can ask and pay an accountant to advise you. However it's not rocket science. Another approach is to see what would have happened if you had saved (say) 10% or 20% from every receipt - then see whether you need to increase or decrease from there. 3. Spread your tax bill across different tax years One option for those who have highly irregular income streams (eg reliant on sales from solo shows) is to exercise your right as an artist to spread your income across tax years to smooth out the highs and lows. The technical term for the option is "averaging". One of the conditions of claiming is it that your profits are wholly or mainly derived from literary, dramatic, musical or artistic works or designs. In other words it is a tax option solely designed for creative people. This is the latest statement (April 2016) on HS234 Averaging for creators of literary or artistic works (2015). Authors and artists who have fluctuating profits may pay a large amount of tax in a good year and little or no tax in a bad year. A relief, introduced in the March 2001 Budget, allows such people to average their profits for successive tax years. This can reduce their total tax bill for the 2 years concerned. The relief replaces previous reliefs for spreading of royalties and sums received for the sale of works of art. The same sort of people will benefit but this relief is simpler and more people will be able to claim. If you want to take advantage of averaging you either need to read the tax advice on HMRC website VERY carefully and/or consult a tax adviser.

You can read more about Tax Tips for Artists on this websit

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Wanting to find out about the business side of art?

Art Business Info. News for Artists

Successful artists get on top of the business side of being an artist. Do you want to: Visitors so farNo. of visitors since April 2015:

and receive every post via email.

AuthorKatherine Tyrrell writes about art, artists and the art business and has followers all over the world. She also delivers workshops for art organisations and reviews websites and career strategies for artists. Art Business Blogs

Art Biz Blog (Alyson Stanfield) ArtBusiness.com (Alan Bamberger) Art Business News ArtsBusiness Institute Art Marketing News (Barney Davey) ArtPromotivate - Tips Artsy Shark (Carolyn Edlund) Be Smart about Art (Susan Mumford) edward_winkleman Fine Art Views (Clint Watson) Laura C George Professional Artist - News Right Brain Rock Star - no longer publishing Savvy Painter Podcasts The Abundant Artist (Cory Huff) The Art Law Blog The Clarion List - Blog Archives

January 2024

Categories

All

|

This website aims to provide a compendium of resources about the art business for artists. Please read "PLEASE NOTE"

It helps artists learn how to do better at being business-like, marketing and selling their art and looking after their financial security.

|

Copyright: 2015-2021 Katherine Tyrrell | Making A Mark Publications

- all rights reserved If you've got any suggestions for what you'd like to see on this website please send me your suggestion

|

PLEASE NOTE:

1) Content and the law change all the time. It's impossible to keep up with it if you're not working on the topic full time. 2) I research topics carefully. However, I am totally unable to warrant that ANY and/or ALL information is

|

3) Hence all information I provide comes without any LIABILITY whatsoever to you for any choices you make.

4) This website is FREE FOR YOU but not for me. Links to books are Amazon Affiliate links. Buying a book via this website means I get a very small payment which helps to fund and maintain this website. .I much appreciate any support your provide. Adverts are provided by Google AdSense - but the adverts do not mean I endorse the advertiser. |

- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING

RSS Feed

RSS Feed