- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING

Reader's question #1: Are taxes the same for all income - and what about travel expenses?Two questions from a reader:

Are taxes the same for all different sources of income?In the UK, the answer is ALL INCOME is liable to tax assessment - no matter how you earn it. In fact, my P60 (for my pension) has a neat quote in it which I've added into the HMRC section of Tax Tips for Artists. By law you are required to tell HM Revenue & Customs about any income that is not fully taxed, even if you are not sent a tax return. Can I deduct my travel expenses from my income before tax?Whether you can claim travel expenses depends on how you earn your income You may not be aware but many artists do NOT just earn income from sales of their paintings. Very many professional artists who also teach earn income:

The issue of whether or not you can claim travel expenses relates to whether or not you are a sole trader and wholly responsible for all your actions. So for example, (in the UK) if you are an employee with a contract of employment and what you do is dictated by others (eg you teach a set curriculum); you are managed and assessed as to competence by others and paid on a monthly basis - then you can't claim home to work travel expenses. That's because you are the same as every other employee in the UK - and employees can't claim home to work (and back again) expenses as a business expense. However if you are completely freelance and have a number of different people who hire you to teach art and/or you deliver your own workshops at different venues you hire around the country - then you are self-employed and you can then claim your travel expenses. Basic principles: you can only claim travel expenses:

EXAMPLES:

Note: This article is intended to be for general information and is should not be relied on as definitive tax advice. It's your responsibility to check the rules for the country where you live and work and the relevant tax year. The tax rules may be similar or they may be different.

Enough said? The deadline for submission of your online self-assessment form as a sole trader to HMRC is 31st January - or you become liable to pay a fine - which gets bigger the longer you leave it.

I've just done my tax but made a point of reading all your advice first. It felt very supportive and extremely helpful to read what you said, the way you write and break it down into manageable sections really worked for me.

Three key questions about pricing art:

and three related polls about pricing art for artists PLUS links to some interesting facts about pricing art Please vote and then view the results. For more about the prevailing trends see the related pages on this website - detailed under the poll.

See How to Price your Art - an introduction to the topic

See

The final poll looks at pricing your art on your website and/or blog?

More about pricing art

Are you maybe under or over-estimating the importance of price to selling art to prospective purchasers and art collectors? How important is price when buying art reviews where price comes in a list of top ten reasons why people buy art.

Did you know there are some BIG hurdle numbers which you MUST take account of when working out a price for your art.

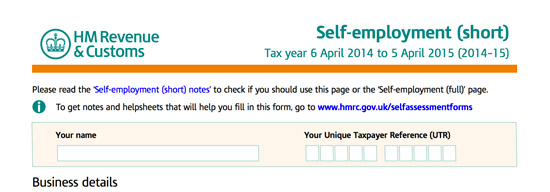

Sometimes artists are effectively 'blinded' by the technical terms used by galleries in contracts for representation. Terminology & Formulas for Pricing Art explains the special words used for pricing art; terms used in art business contracts and the formula for pricing art and finally.... Don't take my word for it. Take a look at the views and opinions of otherArt Experts on Pricing Art UK Tax Returns 2014-15 - deadline 31 January 2016Artists in the UK who are just now remembering they need to complete their Self-Assessment tax returns for their self-employed income by 31 January may find my Tax Tips for Artists page useful. This includes three sections of particular relevance to UK artists:

Digital Tax accounts and quarterly reportingTax Tips for Artists has recently been updated with some outline information about the proposed new digital tax account and quarterly reporting for all those having a turnover in excess of £10,000 p.a.

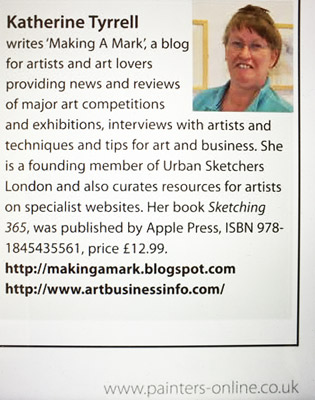

Making tax digital (pdf) is the formal paper setting out what changes the government proposes to introduce and how it will work. Consultation on the proposals is occurring at present so nothing as yet is set in stone. I'll be writing more about this in future. If you want to stay in touch with updates about art business matters generally and digital tax accounting and quarterly reporting in particular please subscribe to this blog. I've been commissioned to write a series of ten articles for The Artist Magazine - part of Painters Online. They'll be published on the last page of the magazine (page 66) throughout 2016.

The articles will look at more cost-effective practices and money-saving tips related to the the business of being an artist. If you'd like to read my series of articles - and the rest of what is an excellent magazine - you can access the different ways to subscribe via the website. The magazine is also available in digital format and consequently can be read by anybody anywhere in the world Alternatively you can browse a selection of pages taken from the December issue of The Artist below - and buy a copy of subscribe to the magazine.

|

Wanting to find out about the business side of art?

Art Business Info. News for Artists

Successful artists get on top of the business side of being an artist. Do you want to: Visitors so farNo. of visitors since April 2015:

and receive every post via email.

AuthorKatherine Tyrrell writes about art, artists and the art business and has followers all over the world. She also delivers workshops for art organisations and reviews websites and career strategies for artists. Art Business Blogs

Art Biz Blog (Alyson Stanfield) ArtBusiness.com (Alan Bamberger) Art Business News ArtsBusiness Institute Art Marketing News (Barney Davey) ArtPromotivate - Tips Artsy Shark (Carolyn Edlund) Be Smart about Art (Susan Mumford) edward_winkleman Fine Art Views (Clint Watson) Laura C George Professional Artist - News Right Brain Rock Star - no longer publishing Savvy Painter Podcasts The Abundant Artist (Cory Huff) The Art Law Blog The Clarion List - Blog Archives

January 2024

Categories

All

|

This website aims to provide a compendium of resources about the art business for artists. Please read "PLEASE NOTE"

It helps artists learn how to do better at being business-like, marketing and selling their art and looking after their financial security.

|

Copyright: 2015-2021 Katherine Tyrrell | Making A Mark Publications

- all rights reserved If you've got any suggestions for what you'd like to see on this website please send me your suggestion

|

PLEASE NOTE:

1) Content and the law change all the time. It's impossible to keep up with it if you're not working on the topic full time. 2) I research topics carefully. However, I am totally unable to warrant that ANY and/or ALL information is

|

3) Hence all information I provide comes without any LIABILITY whatsoever to you for any choices you make.

4) This website is FREE FOR YOU but not for me. Links to books are Amazon Affiliate links. Buying a book via this website means I get a very small payment which helps to fund and maintain this website. .I much appreciate any support your provide. Adverts are provided by Google AdSense - but the adverts do not mean I endorse the advertiser. |

- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING

RSS Feed

RSS Feed