- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING

|

Covid or no covid, in the UK:

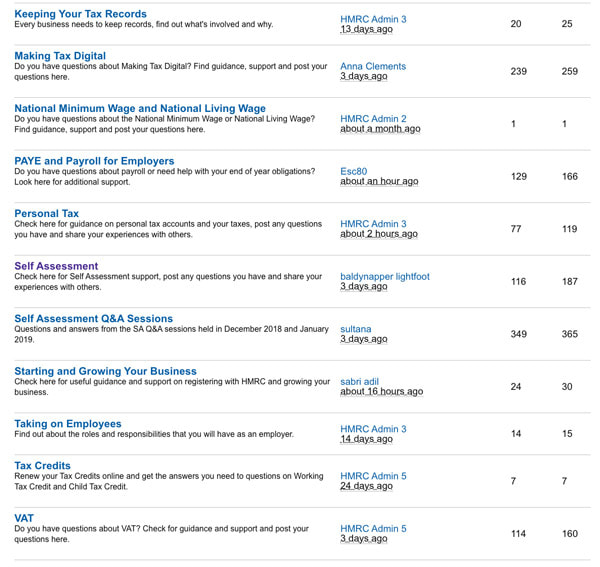

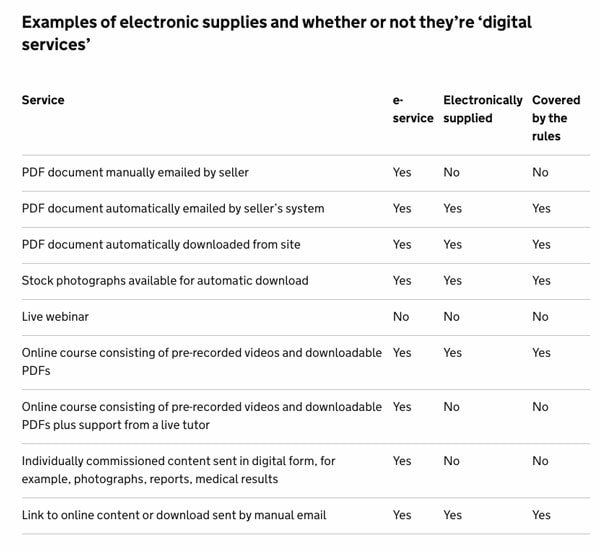

I'm guessing most artists are already online with their tax returns - but for those of you who are not, now is the time to get your act together if you generate more than £10k turnover p.a. HMRC are providing a lot of help in terms of how to make it easier to get your tax right and manage your tax affairs more efficiently. HMRC Info and Guides |

Wanting to find out about the business side of art?

Art Business Info. News for Artists

Successful artists get on top of the business side of being an artist. Do you want to: Visitors so farNo. of visitors since April 2015:

and receive every post via email.

AuthorKatherine Tyrrell writes about art, artists and the art business and has followers all over the world. She also delivers workshops for art organisations and reviews websites and career strategies for artists. Art Business Blogs

Art Biz Blog (Alyson Stanfield) ArtBusiness.com (Alan Bamberger) Art Business News ArtsBusiness Institute Art Marketing News (Barney Davey) ArtPromotivate - Tips Artsy Shark (Carolyn Edlund) Be Smart about Art (Susan Mumford) edward_winkleman Fine Art Views (Clint Watson) Laura C George Professional Artist - News Right Brain Rock Star - no longer publishing Savvy Painter Podcasts The Abundant Artist (Cory Huff) The Art Law Blog The Clarion List - Blog Archives

January 2024

Categories

All

|

This website aims to provide a compendium of resources about the art business for artists. Please read "PLEASE NOTE"

It helps artists learn how to do better at being business-like, marketing and selling their art and looking after their financial security.

|

Copyright: 2015-2021 Katherine Tyrrell | Making A Mark Publications

- all rights reserved If you've got any suggestions for what you'd like to see on this website please send me your suggestion

|

PLEASE NOTE:

1) Content and the law change all the time. It's impossible to keep up with it if you're not working on the topic full time. 2) I research topics carefully. However, I am totally unable to warrant that ANY and/or ALL information is

|

3) Hence all information I provide comes without any LIABILITY whatsoever to you for any choices you make.

4) This website is FREE FOR YOU but not for me. Links to books are Amazon Affiliate links. Buying a book via this website means I get a very small payment which helps to fund and maintain this website. .I much appreciate any support your provide. Adverts are provided by Google AdSense - but the adverts do not mean I endorse the advertiser. |

- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING

RSS Feed

RSS Feed