- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING

|

IF - in addition to employment income you earn - you earn (or aim to earn) more than £10,000 per annum from your self-employment you need to be aware that "Making Tax Digital" (MTD) is becoming MANDATORY for

DO NOT DELAY checking out what this means!! What you need to knowMaking Tax Digital is a key part of the government’s plans to make it easier for individuals and businesses to get their tax right and keep on top of their affairs. The extension of scope of Making Tax Digital relevant to other groups was originally deferred after representations following initial announcement of HMRC's intentions - to make sure the system worked before it was rolled out to smaller businesses.

KEY POINTS AND TIMELINES as at July 2020 as per the Overview of Making Tax Digital. Key points are:

REFERENCE Besides references to paperwork in the HMRC website above,

0 Comments

Major update - art education and digital services |

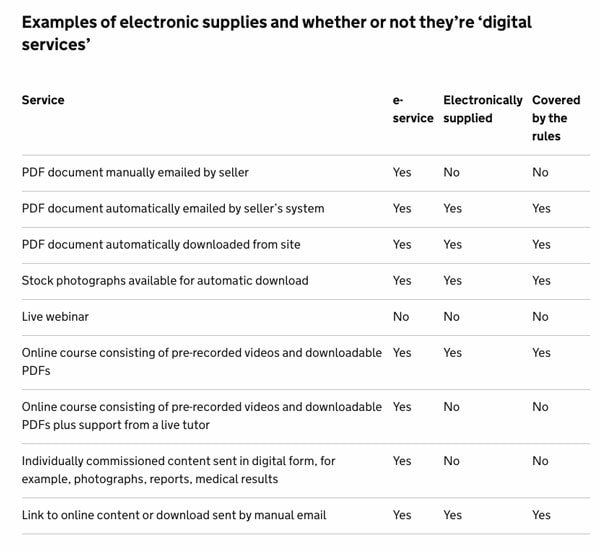

| ABOUT VAT

| ABOUT VAT AND THE ART BUSINESS

|

Learn how and where to find out what you need to know about VAT for:

artists, art teachers, art exhibition and competition organisers, museums and galleries, and VAT on art supplied or sold by artists in UK and/or EU

What's the good news?

- Government guidance on the topic has improved enormously from the time I first became involved with VAT and then subsequently had to deal with VAT returns. It's now a lot more accessible than the legalese I had to deal with in the past!

- VAT almost certainly does not apply to leisure artists and all those making low levels of income from their art.

If you have articles or websites to suggest as useful additions to the page please leave a comment and include the URL. I'll publish the comment if the link is added.

- develop an art career?

- sell your art?

- manage the money side?

Art Business Info. News for Artists

Do you want to:

Visitors so far

Author

Katherine Tyrrell writes about art, artists and the art business and has followers all over the world. She also delivers workshops for art organisations and reviews websites and career strategies for artists.

Art Biz Blog (Alyson Stanfield)

ArtBusiness.com (Alan Bamberger)

Art Business News

ArtsBusiness Institute

Art Marketing News (Barney Davey)

ArtPromotivate - Tips

Artsy Shark (Carolyn Edlund)

Be Smart about Art (Susan Mumford)

edward_winkleman

Fine Art Views (Clint Watson)

Laura C George

Professional Artist - News

Right Brain Rock Star - no longer publishing

Savvy Painter Podcasts

The Abundant Artist (Cory Huff)

The Art Law Blog

The Clarion List - Blog

Archives

January 2024

July 2021

October 2020

September 2020

July 2020

June 2020

May 2020

April 2020

February 2020

January 2020

December 2019

November 2019

October 2019

September 2019

July 2019

April 2019

March 2019

January 2019

December 2018

November 2018

October 2018

August 2018

June 2018

April 2018

March 2018

February 2018

January 2018

December 2017

November 2017

October 2017

September 2017

August 2017

May 2017

April 2017

February 2017

January 2017

December 2016

October 2016

September 2016

August 2016

July 2016

June 2016

May 2016

April 2016

March 2016

February 2016

January 2016

December 2015

November 2015

Categories

All

Advert

Art

Art Auctions

Art Business

Art Business Guide

Art Business Info For Artists

Art Business News

Art Business Practices

Art Career

Art Classes & Workshops

Art Collectors

Art Competitions

Art Education

Art Fairs

Art Galleries

Artists

Artists Home

Art Magazine

Art Marketing

Art Materials

Art Signature

Art Societies

Art Studio

Art Tutors

Artwork Management

Australia

Being An Artist

Best Business Books For Artists

Blogs

Brexit

Business Expenses

Canada

Checklist

Checklists

Commercial Galleries

Copyright

Covid-19

Customs

Data Protection

Digital Services

Direct Sales

DMCA

Drawing

Ecommerce

Email

Email Subscribers

Environmentally Friendly

Equipment

EU

Exhibition

Exhibitions

Export

Facebook

Fine Art Print

Frames

Fundraising

GDPR

Google

Health And Safety

HMRC

How To Guides

How To Mat Artwork

How To Pack Art

How To Price Art

How To Sign

ICO

Image

Image Issues

Images

Import

Income

Insurance

Ireland

Law

Learning

Legal Matters

Legal Matters For Artists

Marketing

Mentoring

Mobile Matters

Money Matters

North America

Office Practices

Online Matters

Online Service Providers

Open Exhibitions

Organising Exhibitions

Packaging

Painting

Pandemic

Paperwork

Paying Artists

PayPal

Presentation Of Art

Press And Publicity

Print On Demand

Promotion

Public Galleries

Recession

Representation

Risk Management

Rules And Regulations

Search Console

Self Employment

Self-employment

Sell Art From Home

Sell Art Online

Selling Art

SEO

Shipping Art

Social Media

Software

Studio Practices

Summary Of Contents

Tax

Tax Tips For Artists

Teaching Art

Techies

Terms And Conditions

Tips And Techniques

Trading Standards

UK

USA

VAT For Artists

Videos For Artists

Websites For Artists

Writing

This website aims to provide a compendium of resources about the art business for artists. Please read "PLEASE NOTE"

It helps artists learn how to do better at being business-like, marketing and selling their art and looking after their financial security.

|

Copyright: 2015-2021 Katherine Tyrrell | Making A Mark Publications

- all rights reserved If you've got any suggestions for what you'd like to see on this website please send me your suggestion

|

PLEASE NOTE:

1) Content and the law change all the time. It's impossible to keep up with it if you're not working on the topic full time. 2) I research topics carefully. However, I am totally unable to warrant that ANY and/or ALL information is

|

3) Hence all information I provide comes without any LIABILITY whatsoever to you for any choices you make.

4) This website is FREE FOR YOU but not for me. Links to books are Amazon Affiliate links. Buying a book via this website means I get a very small payment which helps to fund and maintain this website. .I much appreciate any support your provide. Adverts are provided by Google AdSense - but the adverts do not mean I endorse the advertiser. |

- Home

- NEWS

-

PRACTICE

-

MARKETING

- How to write an Artist's Statement >

- How to write an Artist's Resume or CV >

- How to sign a painting, drawing or fine art print

- Business Cards for Artists

- How to write a press release for an artist

- The Private View Invitation

- Publicity for Juried Exhibitions

- Websites for Artists >

- Image & Video sizes for Social Media Sites

- How to be mobile-friendly

-

SELL ART

- FRAME ART

-

SHIP ART

-

COPYRIGHT

-

MONEY & TAX

- About + Help

- BANKING

RSS Feed

RSS Feed